With all of the recent supply shocks, it’s increasingly obvious that inflation is the wrong target. Today I came across two articles advocating NGDP targeting. Ramesh Ponnuru has a piece in Bloomberg and Norbert Michel has a piece in Forbes.

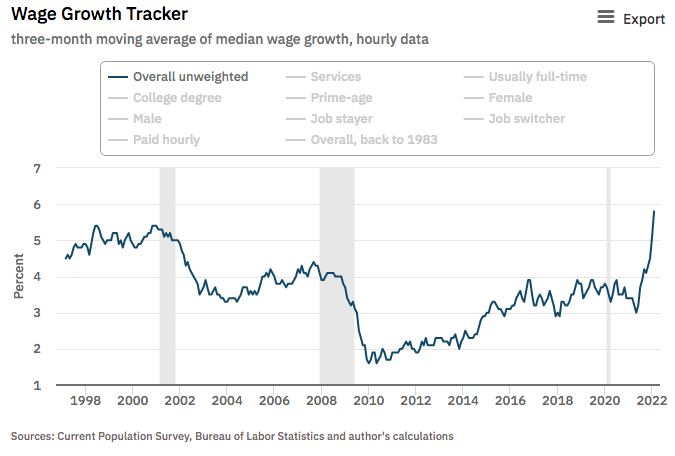

In a recent article, Larry Summers links to this frightening graph showing soaring nominal wage growth:

He’s right, the Fed’s recent mistakes make a recession more likely.

There’s been a lot of discussion of inverted yield curves. Yield curve inversion implies a market forecast of lower future nominal interest rates. It can occur from expectations of slower real growth, slower inflation, as well as a number of other factors. The simplest model is to assume that yield curve inversion predicts slower NGDP growth.

On some occasions, such as 1966, 1981, and today, you would like to see substantially slower NGDP growth, even at the risk of recession. In other cases, a sharp slowdown in NGDP is undesirable, and a sign that monetary policy is too contractionary.

NGDP growth was over 11% over the past year, and will continue at well above trend for at least a few more quarters. I’d like to see NGDP growth fall below 4% in 2023, but not sharply below 4%. That’s much harder to do when the Fed has no credibility, Unfortunately, their recent abandonment of FAIT has cost them a lot of credibility.

It’s like the farmer said to the lost motorist, “First of all, I wouldn’t start from here.”