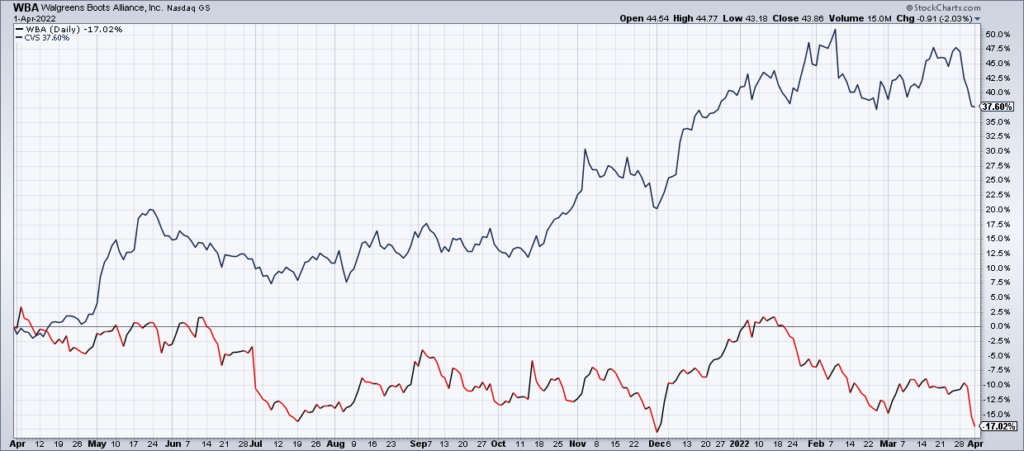

For those of us in the United States, when we need to go to the drugstore it’s either Walgreens or CVS. Personally I don’t have a preference though I know some people prefer one or the other. What consumers don’t know is that investors DO have a preference and its CVS – which has outperformed WBA by 56% over the last 12 months! I’ve been intrigued by this divergence for some time now and took the sell off in WBA after its most recent earnings report Thursday morning to look into it. My conclusion is that it’s time to buy WBA.

The first thing to keep in mind is that CVS and WBA are both more than the drugstores most of us know them by. CVS has two other segments besides for its brick and mortar drugstores – Healthcare Benefits and Pharmacy Services – that made up ~60% of its adjusted operating income in 2021. WBA divides its business into US and international segments. The US segment consists of Walgreens drugstores plus its ~30% stake in Amerisource Bergen (ABC) and the business relationships between the two. International consists primarily of the Boots drugstores – based in the UK – as well as a wholesale and distribution business in Germany. This complicates the analysis of the businesses that might seem simple to those who assume each are just their namesake drugstores.

Nevertheless – in the case of WBA – the US segment makes up more than 80% of revenue in the last 12 months and so we can concentrate our analysis on Walgreens drugstores. And here’s the key point for my thesis: Based on comps, Walgreens drugstores appear to me to be doing every bit as well as CVS drugstores. Therefore, WBA at 9x current year adjusted EPS guidance is a significantly better value than CVS at 12x current year adjusted EPS guidance. If you were a pure technician just looking at the charts, you’d certainly prefer CVS. But if you do the fundamental work like I have, you might share my conviction that WBA will now outperform CVS going forward. It might not happen immediately but I suspect it will over a period of months and years.

To be clear, I like both WBA and CVS in what I foresee as a stagflationary environment going forward. Consumers being squeezed by a contracting economy and inflation will cut back on discretionary items but not necessities. Drugstores sell necessities and so I expect both businesses to do well. It’s just that WBA’s valuation discount means it should outperform CVS.

WBA also has a terrific 4.35% dividend compared to CVS’s 1.98%.

Before concluding I do want to flag a concern noted by Baird analyst Eric Coldwell who downgraded WBA from outperform to hold on Friday. Coldwell noted that while WBA’s adjusted EPS in the first half of its FY22 was +39% to $3.27, it did not raise its full year FY22 guidance of low single digit adjusted EPS growth. That suggests earnings will be under significant pressure in the next two quarters. Why? Based on Coldwell’s note, it appears that WBA will be investing heavily in its business – especially its new Walgreens Health segment. Because I’m a believer in this segment, I’m fine with that and think it will pay off long term. However, it is a potential short term headwind and the question is whether the selloff Thursday and Friday has fully priced it in.