I was talking to a young woman who likes working on cars and wants to start investing in stocks the other day and it occurred to me that the auto parts retailers Autozone (AZO) and O’Reilly (ORLY) might be the perfect stocks for her to start with. When I looked into them I became even more convinced.

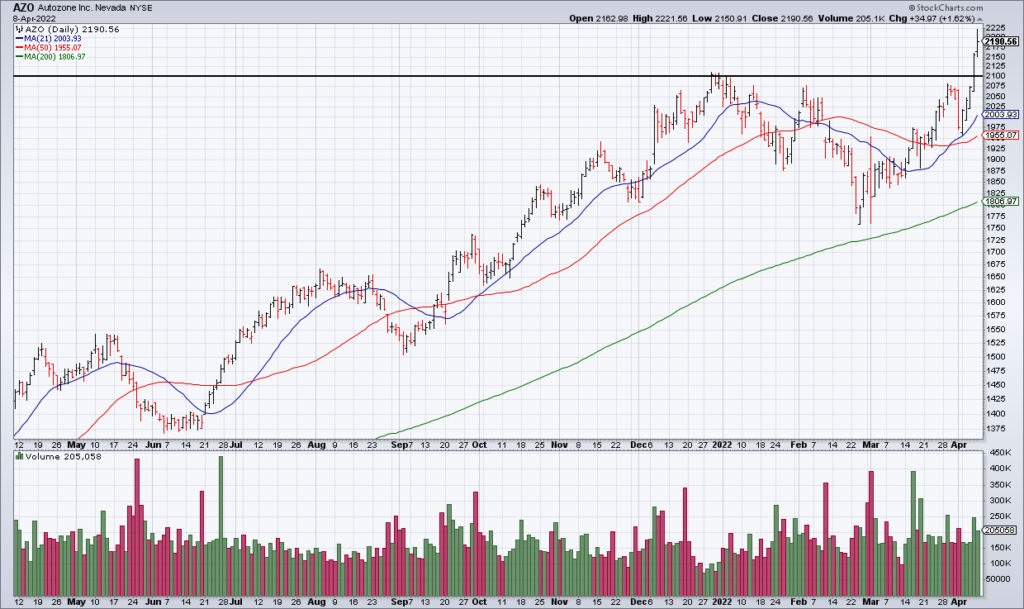

Both AZO and ORLY had fabulous weeks breaking out to new all time highs. While I don’t know why they had such good action last week it does make sense from a fundamental perspective. As we all know by now, the supply chain is under tremendous pressure and none more so than the production of automobiles. This means that everything automotive is at a premium – and that is showing up in the auto parts retailers results.

In its most recent quarter ended in mid-February, AZO had comps of +13.8% and EPS was +49%. In 4Q21, ORLY had similarly gaudy numbers with comps +14.5% and EPS +41%. While the run up in the stocks means they are not cheap they will grow into their valuations.

In addition to benefitting from the strains on the supply chain, auto parts is a defensive business. That is, in tough times consumers will cut back on eating out, new clothes and other luxury goods but they won’t cut back on auto parts. People still need to get to work, pick up their kids and buy groceries. Therefore – though we haven’t seen the stagnation yet – the auto parts retailers will do well in the stagflationary environment I foresee.

For these reasons, AZO and ORLY will continue to outperform and any dip in their stocks is a buying opportunity.