Mortgage applications decreased 5.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 15, 2022.

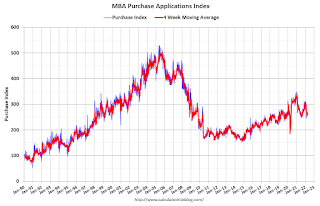

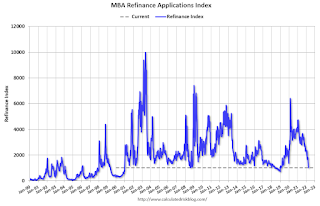

… The Refinance Index decreased 8 percent from the previous week and was 68 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 14 percent lower than the same week one year ago.

“Ongoing concerns about rapid inflation and tighter US monetary policy continued to push Treasury yields higher, driving mortgage rates to their highest level in over a decade. Rates increased across the board for all loan types, with the 30-year fixed rate hitting 5.2%, the highest level since 2010,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The 30-year rate has increased 70 basis points over the past month and is 2 full percentage points higher than a year ago. The recent surge in mortgage rates has shut most borrowers out of rate/term refinances, causing the refinance index to fall for the sixth consecutive week. In a housing market facing affordability challenges and low inventory, higher rates are causing a pullback or delay in home purchase demand as well. Home purchase activity has been volatile in recent weeks and has yet to see the typical pick up for this time of the year.”

Added Kan: “The ARM share of applications reached 8.5% last week, its highest level since 2019. As ARM loans typically have lower rates than fixed rate mortgages, and as this spread has widened, ARM loans have become more attractive to borrowers already facing home purchase loan amounts close to record highs.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.20 percent from 5.13 percent, with points increasing to 0.66 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

The first graph shows the refinance index since 1990.