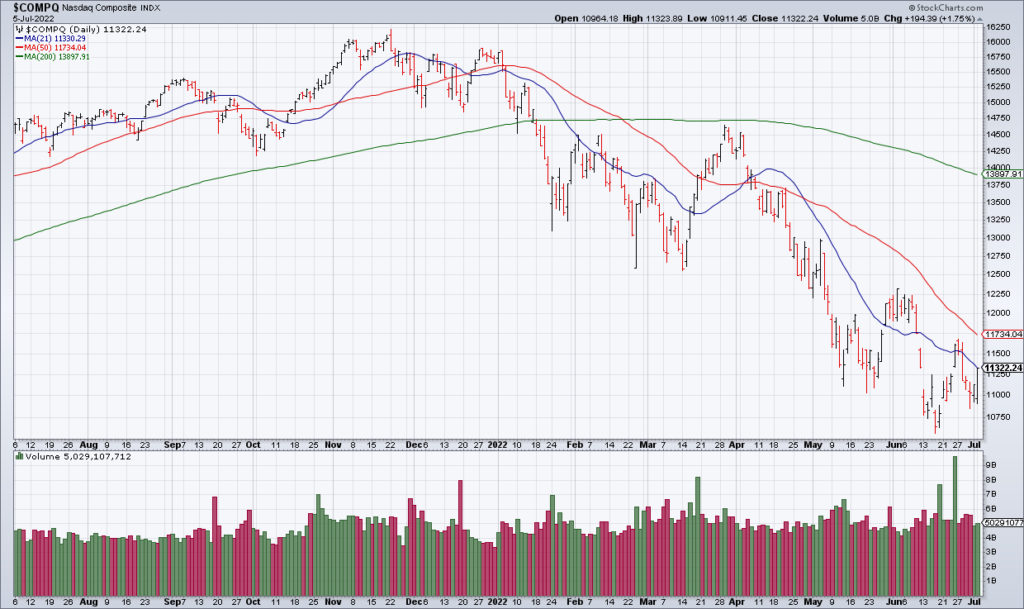

After a summer lull in markets, things are about to pick up next week. 2Q22 earnings season kicks off as well as the crucial June CPI Report on Wednesday July 13. Following that is the Fed Decision on Wednesday July 27. Let’s take each in turn.

Analyst estimates for 2022 S&P earnings are still quite strong at $250 – though they have started rolling over as you can see in the tweet above from Strategas. If $250 is correct, the S&P is cheap at 15x current year earnings. But there is a lot of suspicion that they are too high as concerns about a recession add demand worries to margin concerns. We’ll want to pay close attention as 2Q reports start coming in next week.

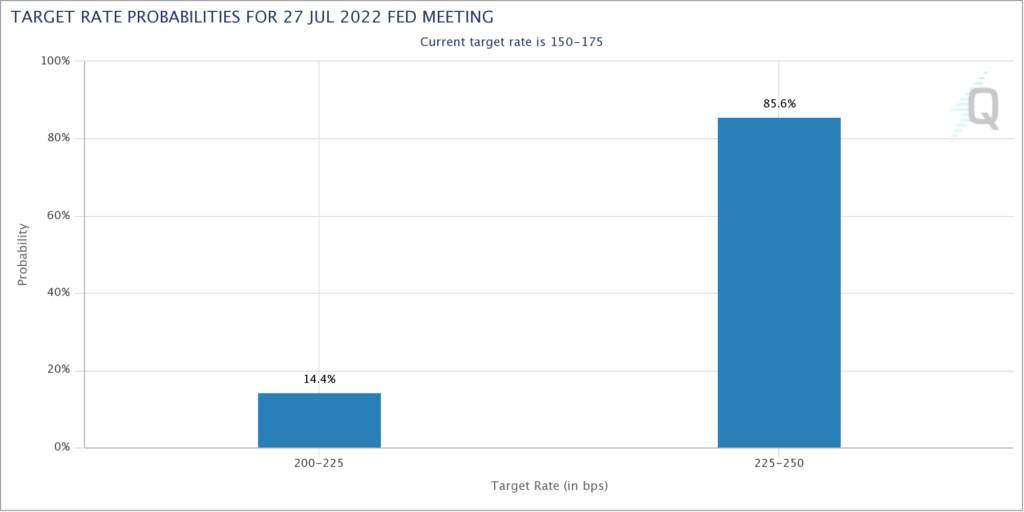

Next let’s turn to inflation and monetary policy. Obviously inflation and the Fed’s hawkish response has been driving markets lower for the last few months. The June CPI Report next Wednesday will be the most important data point for the Fed going into its July 27 decision. At the moment, Fed Futures are pricing in an 86% chance of a 75 basis point hike. But that could change very quickly based on the June CPI Report.

My baseline view is that while EPS estimates are too high that has already been priced in by the market’s nasty downward spiral. In addition, I think an inline June CPI Report will give the Fed cover to hike only 50 basis points. The combination would mean that the lows for the year are in and stocks could enjoy a nice second half rally. Obviously this is very far from the current consensus and will have to be adjusted based on how the data comes in. But for the moment I’m bullish stocks.