For manufacturing, the June Industrial Production report and the July New York Fed manufacturing survey will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 1.1% increase in CPI, and a 0.6% increase in core CPI. The consensus is for CPI to be up 8.8% year-over-year and core CPI to be up 5.8% YoY.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand down from 235 thousand last week.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.5% increase in core PPI.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.8% increase in retail sales.

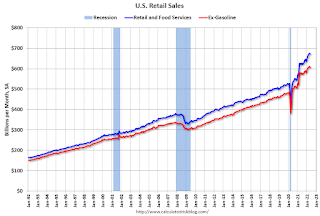

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in May.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -2.6, down from -1.2.

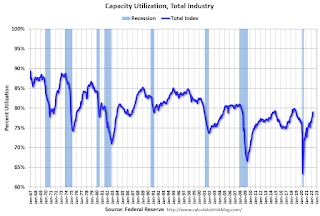

This graph shows industrial production since 1967.

The consensus is for a no change in Industrial Production, and for Capacity Utilization to decrease to 80.4%.

10:00 AM: University of Michigan’s Consumer sentiment index (Preliminary for July).