Other key reports include ISM manufacturing and services indexes, July vehicle sales, and the Trade deficit for June.

8:00 AM ET: Corelogic House Price index for June

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 52.0, down from 53.0 in June.

10:00 AM: Construction Spending for June. The consensus is for a 0.2% increase in construction spending.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for July.

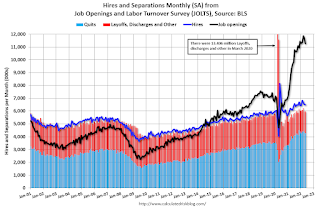

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in May to 11.254 million from 11.681 million in April.

The number of job openings (yellow) were up 17% year-over-year and Quits were up 11% year-over-year.

10:00 AM: the Q2 2022 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

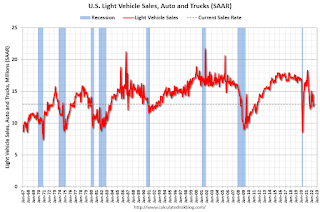

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: the ISM Services Index for July. The consensus is for a reading of 53.5, down from 55.3.

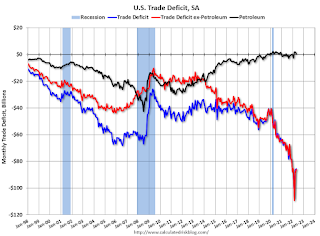

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau.

This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $80.1 billion. The U.S. trade deficit was at $85.5 Billion the previous month.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand up from 256 thousand last week.

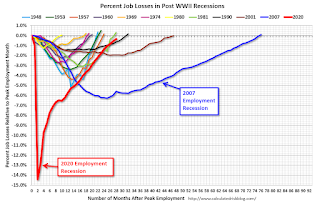

8:30 AM: Employment Report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for July. The consensus is for 250,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

There were 372,000 jobs added in June, and the unemployment rate was at 3.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 28 months after the onset, has recovered quicker than the previous two recessions.