What is the one common feature of all recessions? The answer is easy. During every single recession, the media is full of reports that this recession is utterly unlike anything in the past. I discussed this point in my book The Money Illusion, but I might as well have been spitting into the wind.

Here’s Bloomberg:

These are strange times, which means the last 30 years of data — maybe even the last 50 years — don’t offer much insight. The normal indicators may not tell us much of anything at all. Even the reliable inverted yield curve that’s supposed to predict recession may be less reliable after years of quantitative easing followed by quantitative tightening.

Perhaps there will be no inflection point when a recession hits. Maybe inflation falls and then we just recover. That’s not unprecedented, but we are entering this period from a different place than we’ve ever been before.

To me, the economic situation seems utterly normal. There was too much demand stimulus, NGDP rose too fast, inflation increased, and policymakers are finally beginning to contemplate steps that would bring inflation down. So what’s new?

In my book, I cited a Time magazine article from 1991 explaining how the recession at that time (which was utterly normal) was supposedly nothing like anything we’d seen before. Today, the article seems almost comical.

Much of the confusion comes from the fact that most journalists and economists are working with the wrong model. The business cycle is actually quite simple. Monetary policy drives NGDP and NGDP drives fluctuations in RGDP. And interest rates do not tell us anything useful about the stance of monetary policy. For that you need to look at NGDP and NGDP expectations.

If you think the Fed has been tightening monetary policy for a year, you might wonder why the economy keeps chugging along with rapid NGDP growth. But what makes you think the Fed’s been tightening monetary policy for the past year? Interest rates?

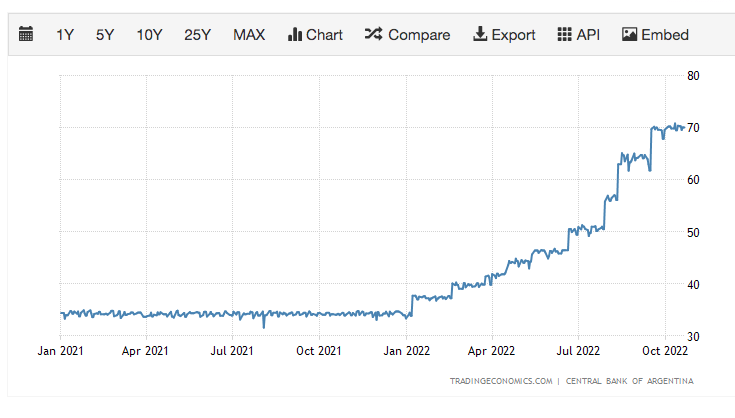

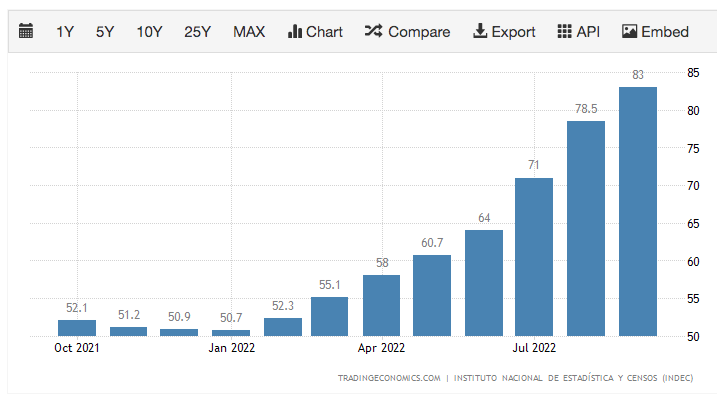

Here are interest rates in Argentina:

Wow, those sharply rising interest rates must be driving inflation much lower!

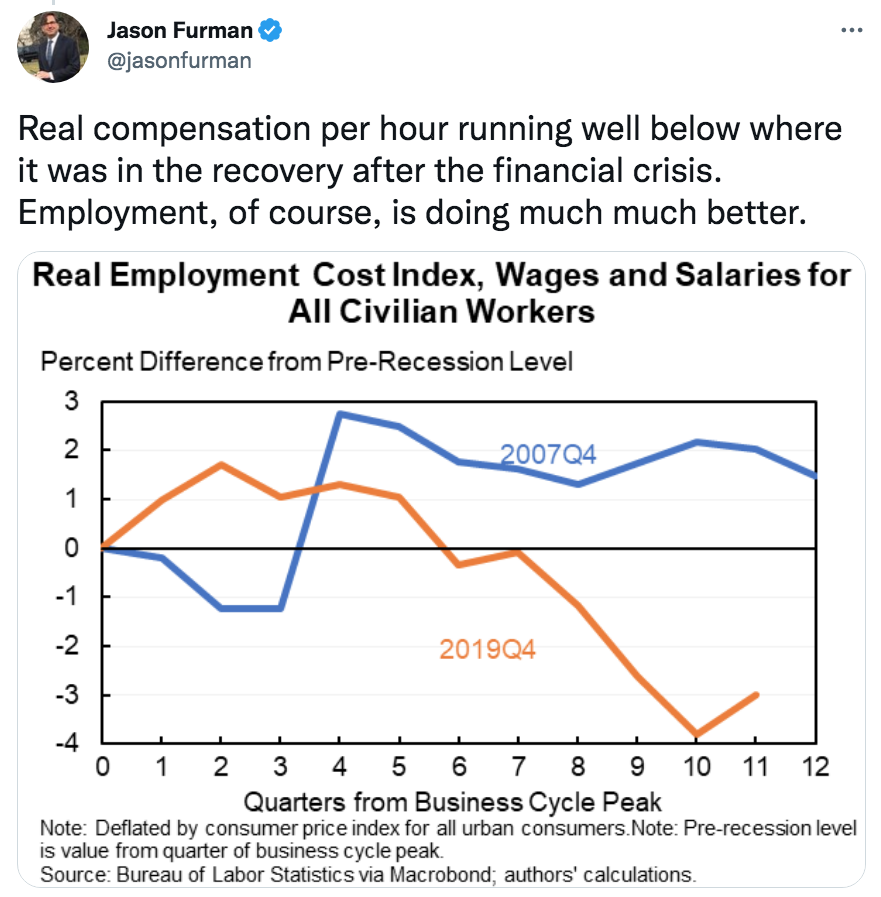

PS. Slightly off topic, but commenters used to be surprised when I told them that easy money wouldn’t improve real wages. The whole point of stimulus is to lower real wages so that firms hire more workers: