From Matthew Graham at Mortgage News Daily: Have We Mentioned CPI and The Fed?

From Matthew Graham at Mortgage News Daily: Have We Mentioned CPI and The Fed?

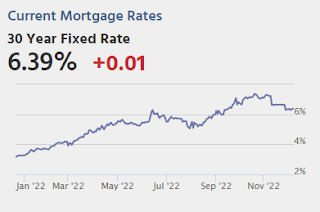

It’s been more than a month since the last CPI report sent mortgage rates lower at the fastest single-day pace on record. Since then, apart from one interesting reaction to Powell’s speech two weeks ago, the main order of business has been to wait for the next CPI report and the Fed announcement that would follow a day later. As the new week begins, we’re a mere 24 hours away. That makes today a placeholder of the highest order. Volatility is possible, especially after the 1pm 10yr Treasury auction, but it pales in comparison to what tomorrow may bring. [30 year fixed 6.39%]

emphasis added

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 7.3% year-over-year and core CPI to be up 6.1% YoY.