— Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 16, 2022.

… The Refinance Index increased 6 percent from the previous week and was 85 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 36 percent lower than the same week one year ago.

“The Federal Reserve raised its short-term rate target last week, but longer-term rates, including mortgage rates, declined for the week, with the 30-year conforming rate reaching 6.34 percent – its lowest level since September,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Refinance application volume increased slightly in response but was still about 85 percent below year-ago levels. This is a particularly slow time of year for homebuying, so it is not surprising that purchase applications did not move much in response to lower mortgage rates.”

Added Fratantoni: “The latest data on the housing market show that homebuilders are pulling back the pace of new construction in response to low levels of traffic, and we expect this weakness in demand will persist in 2023, as the U.S. is likely to enter a recession. However, if mortgage rates continue to trend down, as we are forecasting, more buyers are likely to return to the market later in the year, as affordability improves with both lower rates and slower home-price growth.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 6.34 percent from 6.42 percent, with points decreasing to 0.59 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

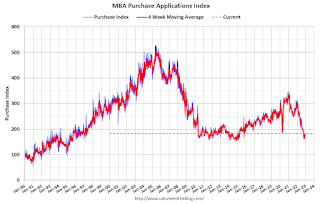

The first graph shows the refinance index since 1990.