I’m adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was up 4.7% YoY through November. This was down from a peak of 5.4% in early 2022. The FOMC is forecasting the YoY change in core PCE will be in the 3.2% to 3.7% range in Q4 2023. Will the core inflation rate decrease in 2023, and what will the YoY core inflation rate be in December 2023?

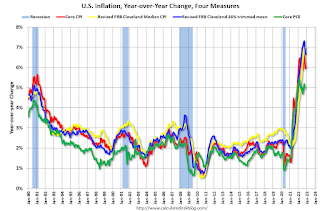

Although there are different measure for inflation, they all show inflation well above the Fed’s 2% inflation target.

Note: I follow several measures of inflation, including median CPI and trimmed-mean CPI from the Cleveland Fed. Also core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. The recent spike in inflation is obvious, and inflation appears to have peaked.

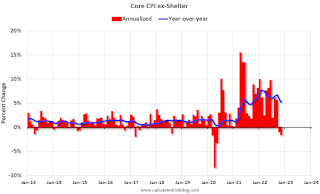

This “dramatic shift” in household formation is leading to Rents Falling Faster than “Seasonality Alone”. Since rents are falling – and will likely continue to fall – it probably makes sense to look at inflation ex-shelter for monetary policy over the next several months.

• Question #6 for 2023: What will the Fed Funds rate be in December 2023?

• Question #7 for 2023: How much will wages increase in 2023?

• Question #8 for 2023: How much will Residential investment change in 2023? How about housing starts and new home sales in 2023?

• Question #9 for 2023: What will happen with house prices in 2023?

• Question #10 for 2023: Will inventory increase further in 2023?