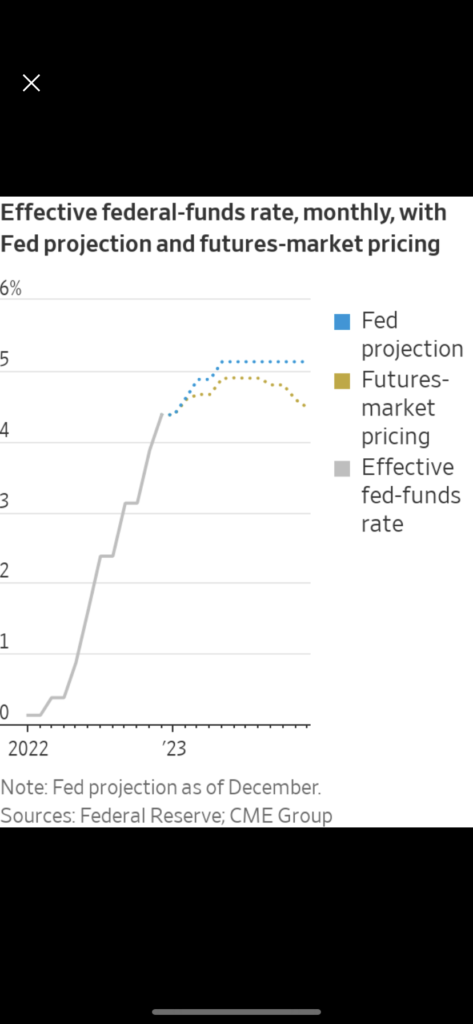

There is an article coming on the front page of Friday’s WSJ that you are going to want to read (“Markets, Fed Split On Rate Forecasts”, Timiraos and Otani [SUBSCRIPTION REQUIRED]). As you can see in the graph above from the article, the Fed is saying that it will raise rates higher and hold them there for longer than the market expects. What accounts for the divergence?

The main reason for this is that the Fed wants the market to believe that it is extremely hawkish in order to prevent the market from rallying, which would loosen financial conditions and make its fight against inflation more difficult. In other words, the Fed’s projections are not credible because they’re not meant to be. They’re essentially marketing.

Now it’s worth pointing out that the Fed said last year that it was going to be extremely hawkish and the market didn’t believe it – incorrectly. So it’s possible the same thing could happen this year. The problem is that – with the economy rolling over – an overly hawkish Fed would amount to a policy mistake in the other direction that will exacerbate what is already likely to be a nasty recession.

I’m not going to pretend to know what the Fed is going to do but because I believe inflation is rolling over at the same time that the economy is starting to contract, a pivot in the near future would be good policy. In addition, the Fed will face pressure from the administration and the public as the economic pain mounts. It’s possible that Powell and company could do the wrong thing as well as face down political pressure and public opinion. I just think it’s unlikely. But I will make adjustments as things evolve and so should you.