Other key indicators include January ISM manufacturing and services surveys, and January vehicle sales.

The FOMC meets this week, and the FOMC is expected to announce a 25 bp hike in the Fed Funds rate.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed manufacturing surveys for January.

9:00 AM: FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

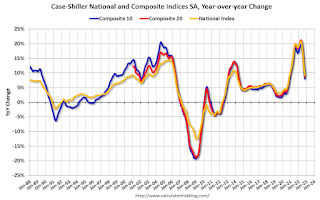

This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.9% year-over-year increase in the Comp 20 index.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 44.9, down from 45.1 in December.

10:00 AM: The Q4 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in January, down from 235,000 added in December.

10:00 AM: Construction Spending for December. The consensus is for a 0.1% decrease in construction spending.

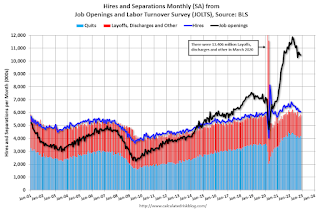

This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Job openings decreased in November to 10.458 million from 10.512 million in October

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 48.0, down from 48.4 in December.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce a 25 bp hike in the Fed Funds rate.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

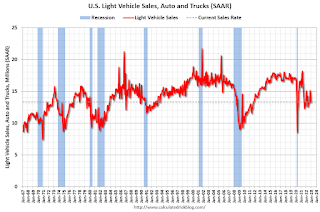

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 200 thousand initial claims, up from 186 thousand last week.

8:30 AM: Employment Report for December. The consensus is for 185,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for December. The consensus is for 185,000 jobs added, and for the unemployment rate to increase to 3.6%.

There were 223,000 jobs added in December, and the unemployment rate was at 3.5%.

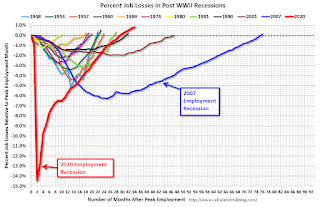

This graph shows the job losses from the start of the employment recession, in percentage terms.

The pandemic employment recession was by far the worst recession since WWII in percentage terms. However, as of August 2022, the total number of jobs had returned and are now 1.24 million above pre-pandemic levels.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.3, up from 49.6 in December.