From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump to Highest Levels in a Month

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump to Highest Levels in a Month

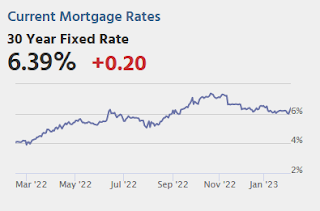

Mortgage rates were already under quite a bit of pressure on Friday following the stunningly strong jobs report in the morning. Strong economic data is generally bad for rates. One reason for that is the data’s impact on decisions made by the Federal Reserve. This is especially true of the jobs report. …

In the space of just two days, the average lender is nearly half a percent higher on a top tier conventional 30yr scenario. [30 year fixed 6.39%]

emphasis added

Tuesday:

• At 8:00 AM ET, CoreLogic House Price index for December.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $68.5 billion. The U.S. trade deficit was at $61.5 billion in November.

• At 12:40 PM, Discussion Fed Chair Jerome Powell, Conversation with David Rubenstein, Chairman of the Economic Club of Washington, D.C. at the Economic Club of Washington, D.C.