From Matthew Graham at Mortgage News Daily: Mortgage Rates Started Lower, But Rose Intraday

From Matthew Graham at Mortgage News Daily: Mortgage Rates Started Lower, But Rose Intraday

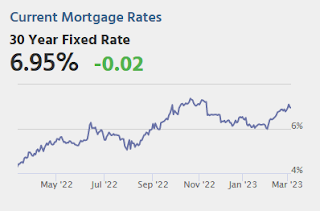

Mortgage rates have been hovering around the highest levels in months over the past 2 weeks, but had made a bit of progress by the end of last week. The improvement carried over into the early part of today. In other words, the average lender was offering just slightly lower rates this morning compared to the end of last week.

Unfortunately, as the day progressed, the bond market began losing ground. Bonds dictate day-to-day changes in rates. As such, the average mortgage lender was forced to recall their initial rate sheets and “reprice” to slightly higher rates.

This brings the average lender up to the 7% neighborhood for the average conventional conforming 30yr fixed scenario. [30 year fixed 6.95%]

emphasis added

Tuesday:

• At 8:00 AM: CoreLogic House Price index for January.

• At 10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs