The world needs to get its hands on as much lithium supply, if our climate goals are to be met. Right now, according to National Defense, “Lithium batteries are predicted to be one of the key technologies of the 21st century, powering everything from electric vehicles to military systems, power grids and industrial electronics. By 2030, global demand for the batteries is expected to increase more than five times, and U.S. demand nearly six times. However, the U.S. battery supply chain is hampered by a heavy reliance on foreign imports and a lack of domestic support.” That being said, we only expect for the lithium bull market to accelerate, which is great news for Q Battery Metals Corp. (CSE: QMET) (OTC: BTKRF), Albemarle Corporation (NYSE: ALB), Lithium Americas (NYSE: LAC) (TSX: LAC), American Lithium Corp. (NASDAQ: AMLI) (TSXV: LI), and Piedmont Lithium (NASDAQ: PLL).

Look at Q Battery Metals Corp. (CSE: QMET) (OTC: BTKRF), For Example

Q Battery Metals Corp. provided an update on the exploration targeting on their mineral claims located north of Val d’Or, Quebec. In particular, the potential for lithium mineralization has recently become a new focus for the claims.

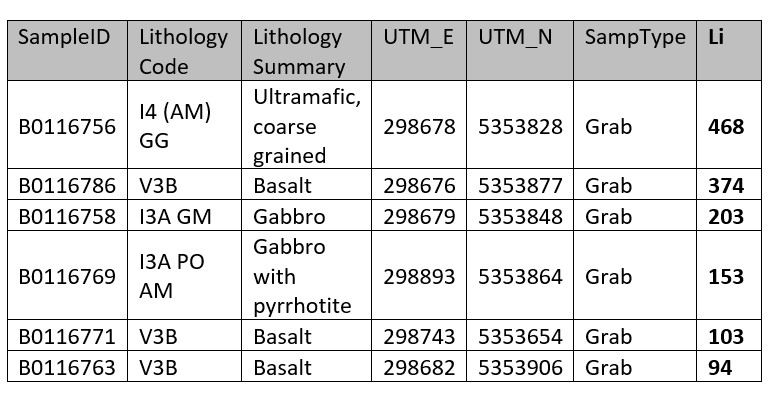

Preliminary review of the rock sampling results from the 2021 Q Battery Metals work program indicates elevated lithium in the area of the Boily-Berubé mineral showing. Table 1 summarizes rock samples that returned elevated lithium. The samples were obtained to test for VMS potential and were not targeted on rocks that might better return lithium results.

The Boily-Berubé mineral showing is documented as being associated with granitic pegmatites. Stripping carried out in 1989 exposed a pegmatitic vein containing molybdenite with some grains of pyrite and traces of chalcopyrite and malachite (GM49151). Several coarse quartz veins were exposed in the area of the showing, with some returning elevated molybdenum and bismuth values (GM16255).

The Lac Fiedmont South mineral showing, on the eastern margin of the Q Battery Metals claims, has similar geology to the Boily-Berubé, including molybdenite hosted in pegmatite.

Table 1 – Summary of 2021 Rock Sampling, elevated lithium

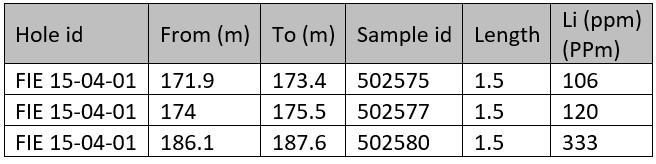

Initial review of historic drilling on the La Corne South indicates that pegmatitic rocks were intersected in drilling undertaken by Noranda Inc. in 2004, while they were exploring base metal targets. Not all of the core was sampled for lithium, but one hole (FIE-15-04-01, report GM62134) where sampling for lithium was undertaken, returned up to 333 ppm lithium (186.1-187.6 metres depth). This drill hole was collared one kilometre northwest of the Boily-Berubé showing. A summary of lithium results from this 2004 drill hole is provided on table 2. The drill hole was oriented at a -45 degree angle toward azimuth 054, intersecting komatiite with interstitial coarse grained granite. The drill hole also returned elevated copper and molybdenum values.

Table 2 – Summary of lithium results from drill hole FIE-15-04-01 (Noranda, 2004)

The reader is cautioned that historic trenching and drilling results reported by various operators have not been verified by Q Battery Metals.

Q Battery Metal’s La Corne South Project contact the La Corne Batholith within the northern section of the claim block. The La Corne Batholith and the volcanic rocks on the margin of the batholith host several well-documented lithium deposits. Of particular significance, approximately 10 kilometres to the north, Sayona Mining Ltd is in the process of restarting the North American Lithium (NAL) mine. The NAL mine has a reported proven ore reserve of 1.2 million tonnes of 0.92% Li2O and probable reserve of 28 million tonnes of 0.96% Li2O (https://www.mining.com/sayona-raises-136m-for-quebec-lithium-projects-restart-in-2023/).

The reader is cautioned that potential lithium resources that exist on properties outside of the Q Battery Metals claims are not direct indicators of lithium mineralization on the claims.

The La Corne lithium mineralization is hosted in a series of pegmatitic bodies that cut the hornblende granodiorite of the La Corne Batholite and the mafic volcanic group rocks. The NAL mineralization consists of spodumene, beryl, tantalite, molybdenite, bismithinite and lepidolite contained in granitic pegmatites (Sigeom).

Q Battery Metals is currently planning 2023 exploration programs on their lithium projects as well as continuing to test the best VMS targets outlined on the Mogold and PG Highway claims. The company is pleased with the indications of lithium mineralization documented in the historic work, with exploration designed to test the best targets. Lithium exploration will also be undertaken on the newly acquired Pegalith Project located north of Gatineau (see News Release dated February 6, 2023).

Other related developments from around the markets include:

Albemarle Corporation, a global leader in transforming lithium and bromine into essential ingredients for mobility, energy, connectivity and health, signed definitive agreements with Mineral Resources Limited to restructure the parties’ MARBL lithium joint venture in Australia and separately for MinRes to invest in Albemarle conversion assets in China. “Our Australian lithium assets are core to Albemarle’s strategy to build a globally diversified portfolio of best-in-class assets and resources,” said Kent Masters, Albemarle CEO. “Inherent to that strategy is managing our global portfolio to maximize growth optionality and maintain a leading position in a dynamic, growing market. Our restructured MARBL joint venture enables each partner to deliver long-term value to our customers.”

Lithium Americas commenced construction at its 100%-owned Thacker Pass lithium project in Humboldt County, Nevada, following the receipt of notice to proceed from the Bureau of Land Management. “Starting construction is a momentous milestone for Thacker Pass and one we have been working towards for over a decade,” said Jonathan Evans, President and CEO. “We are excited about the prospect of generating economic growth in Northern Nevada and playing a major role in the domestic lithium supply chain for electric vehicles.”

American Lithium Corp. has appointed DRA Global as lead engineer to coordinate completion of a Pre-Feasibility Study on the Company’s Falchani Lithium Project in Southern Peru. As part of this process, Stantec Consulting Ltd. will also prepare an updated mineral resource estimate on Falchani which will involve the reclassification of existing resource categories, as well as including new drill data from the recent hydrology drilling which commenced in August 2022. The Company also announces that it has restarted additional hydrology drilling at Falchani, with full support from the local communities. This drilling is part of the Environmental Impact Assessment that was commenced in August 2022.

Piedmont Lithium, announced that it has signed agreements with LG Chem, Ltd., under which LG Chem will make a $75 million equity investment in Piedmont and commit to the offtake of 200,000 metric tons of spodumene concentrate from Piedmont’s jointly-owned North American Lithium over a four-year term. LG Chem will purchase 1,096,535 newly-issued shares of Piedmont common stock at an approximate price of $68.40 per share for a total consideration of $75 million. Closing of the Subscription Agreement is expected on or around February 24, 2023, and will result in LG Chem holding approximately 5.7% of Piedmont common shares. Transaction details are described in the table at the end of this announcement.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Q Battery Metals by Q Battery Metals. We own ZERO shares of Q Battery Metals. Please click here for full disclaimer.

Contact Information:

Ty Hoffer

Winning Media

281.804.7972

Ty@winning.media