There were 517,000 jobs added in January, and the unemployment rate was at 3.4%.

“[W]e expect nonfarm payroll growth moderated to 230k, reversing much of the acceleration seen in January. This should still be enough to put downward pressure on the unemployment rate since we expect the labor force participation rate to be unchanged at 62.4%. As a result, we look for the unemployment rate to remain unchanged at 3.4%, but there is a meaningful risk that it rounds down to 3.3%.”

From Goldman Sachs:

“We left our nonfarm payroll forecast unchanged at +250k (mom sa).”

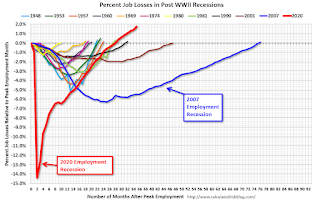

• First, as of January there were 2.70 million more jobs than in February 2020 (the month before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms. As of June 2022, the total number of jobs had exceeded pre-pandemic levels.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in February to 49.1%, down from 50.6% last month. This would suggest 25,000 jobs lost in manufacturing. The ADP report indicated 43,000 manufacturing jobs added in February.

The ISM® services employment index increased in February to 54.0%, from 50.0% last month. This would suggest service employment increased 180,000 in February.

Combined, the ISM surveys suggest 155,000 jobs added in February (below the consensus forecast).

• Unemployment Claims: The weekly claims report showed no change in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 192,000 in January to 192,000 in February. This would usually a similar number of layoffs in February as in January. In general, weekly claims were below expectations in February.