After Silicon Valley Bank (SIVB) failed Friday, its Northern California neighbor First Republic (FRC) was in the crosshairs Monday – dropping 62%. However: FRC is NOT SIVB. SIVB was a an aggressive bank focused on the tech startup community. FRC is a much more conservative bank with a portfolio concentrated in real estate.

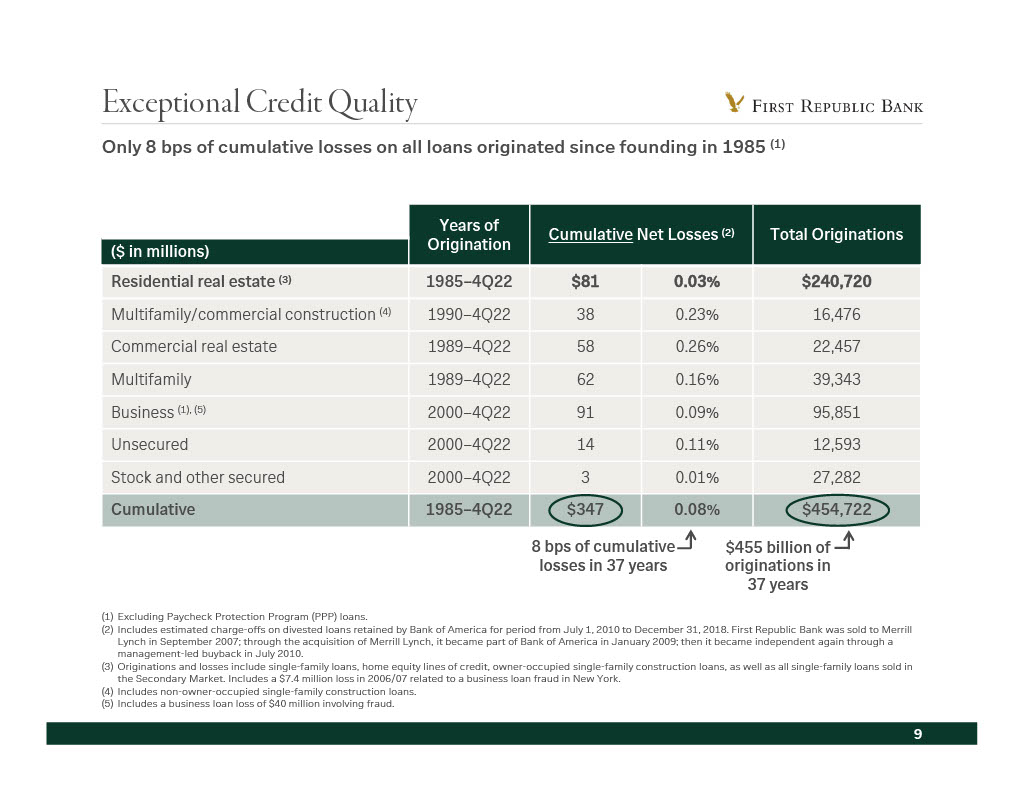

Take a look at the slide at the top of the blog from an FRC presentation from January 13, 2023. Out of a total of $454.7 billion in total loan originations during the course of FRC’s existence they have only lost $347 million or 8 basis points. That is incredible. It means that the assets in FRC’s loan portfolio are stellar. What are those assets?

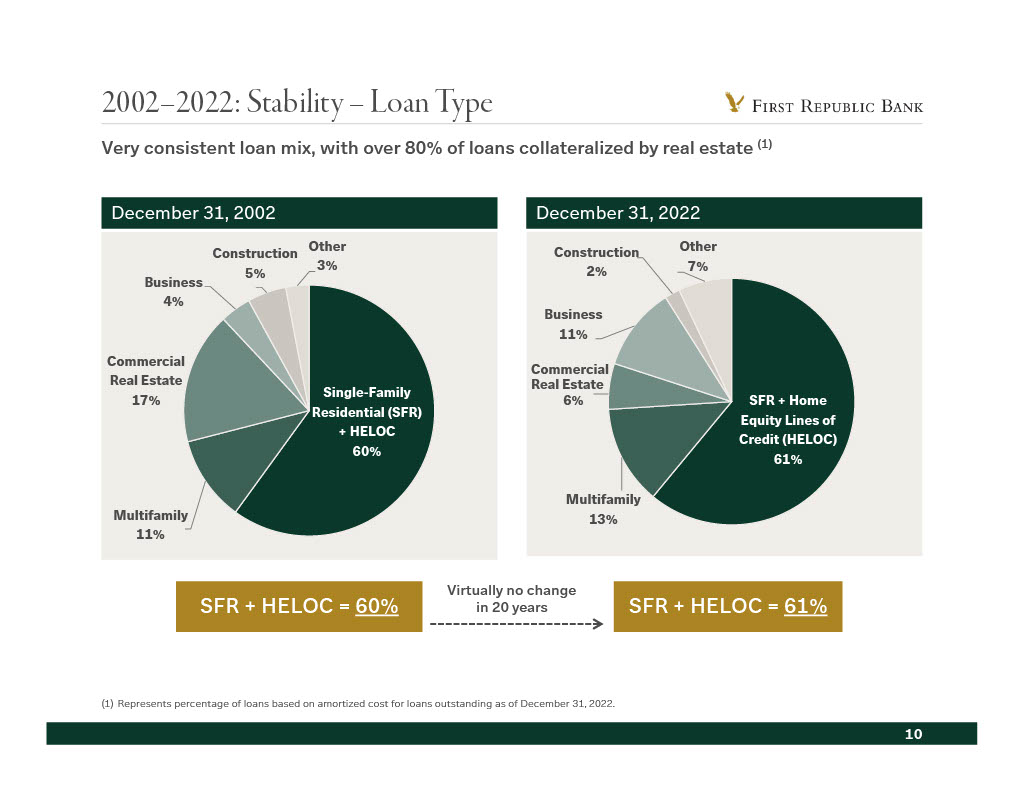

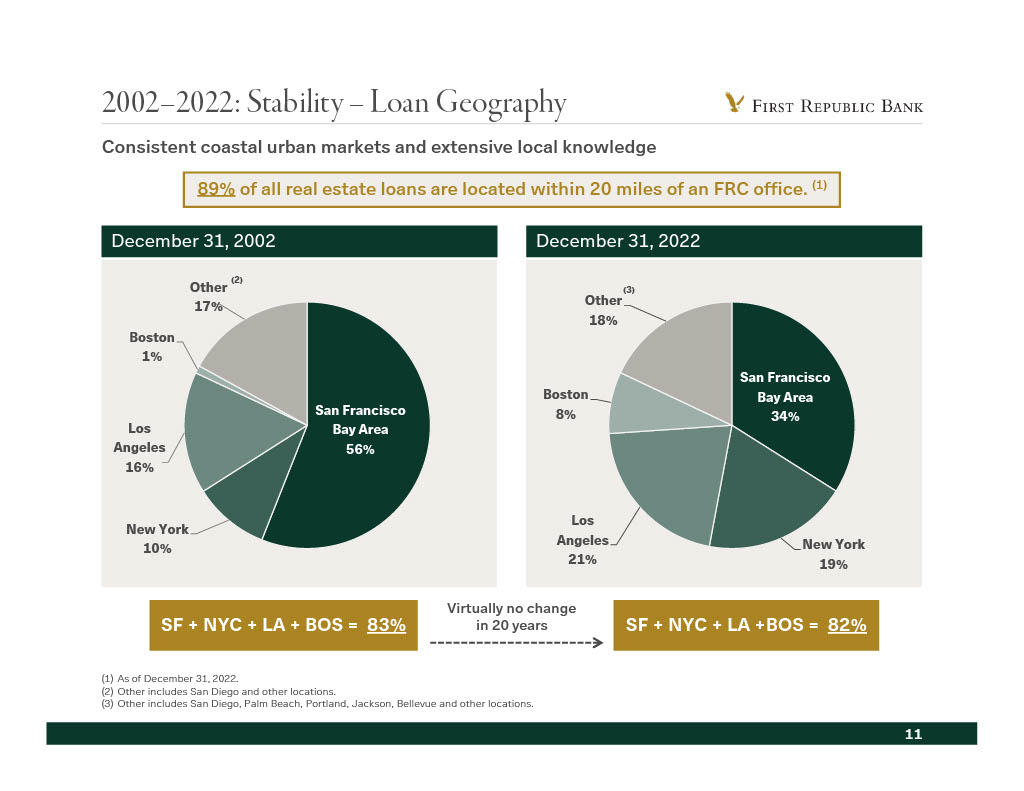

80% of FRC’s loan portfolio ($137 billion out of a total loan portfolio of $167 billion) is in single family homes, apartment and office buildings. And 80% of their loans are in the San Francisco Bay Area, Los Angeles, New York and Boston. In other words, FRC has loans on the best real estate in the country.

In sum, FRC does not have a solvency problem. That is the value of its liabilities is not greater than the value of its assets.

FRC’s problem is immediate liquidity. FRC is funded by $176 billion in deposits as of December 31, 2022. As discussed in this morning’s blog, banks operate on a fractional reserve model. No bank can redeem all its deposits at once in a bank run. They simply don’t hold that much cash. FRC had $4 billion in cash and $32 billion in debt securities – mainly agency MBS and municipal bonds – as of December 31, 2022.

The reason I believe FRC will be okay is that the finance community knows they are a high quality bank. They know it’s a liquidity – not a solvency – problem and would be willing to inject liquidity into FRC for the right price if necessary.

DISCLOSURE: Top Gun owns shares of FRC.