That’s the title of my new book, which can be found for free at this link:

Alternative Approaches to Monetary Policy

A few comments:

1. This is just a rough draft, although it has gone through the editorial process, so I hope there are relatively few typos. I will revise the book after receiving feedback, and the revised book will eventually come out as a “first edition.” That version will also be available online for free, or in paper for a modest price.

2. You can think of this book as addressing the question of how to identify monetary policy. In my view, a big failure of the profession has been the widespread assumption that the Fed adopted an easy money policy in 2008 and a tight money policy in 2022. Both claims are false, indeed exactly the opposite is true. That’s bad!! And that’s what motivates me to keep harping on this issue.

3. These false beliefs about monetary policy have important consequences; they contribute to bad policy decisions.

I’ll have lots more to say about the book in the future. I hope the final version is much better than the current version.

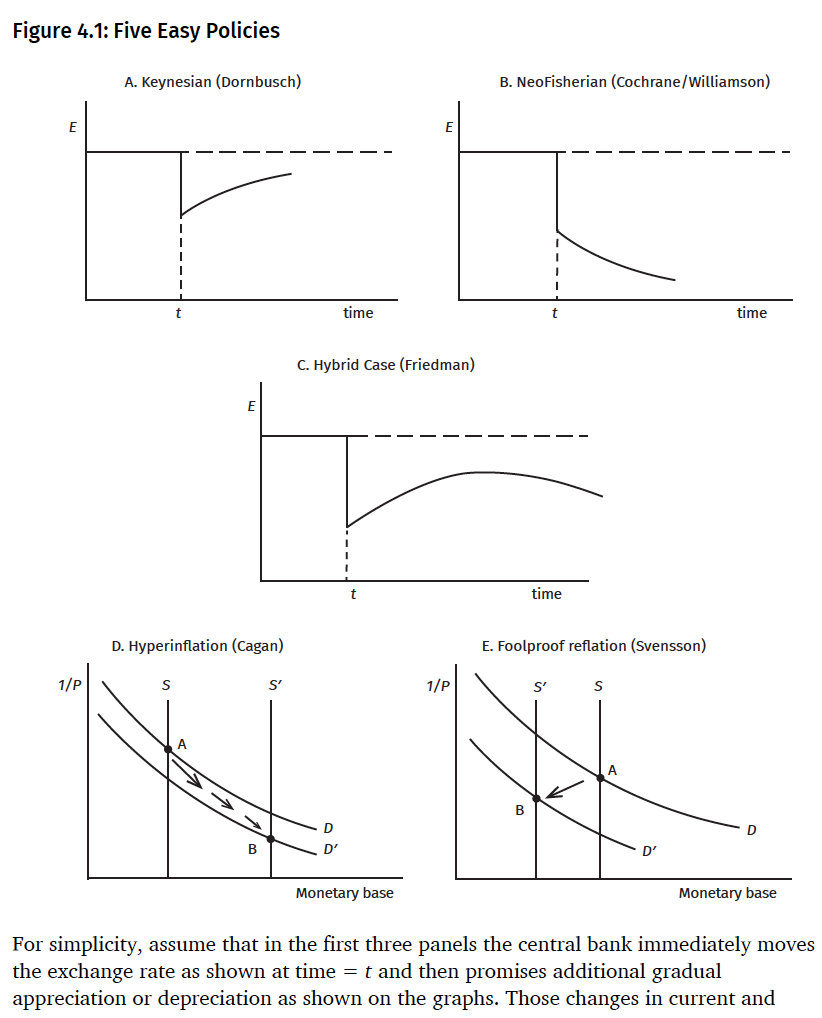

The following graphs from page 101 illustrate some of my views on the relationship between the stance of monetary policy, exchange rates (E), interest rates, and the monetary base.