Mortgage applications decreased 1.4 percent from one week

earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications

Survey for the week ending June 2, 2023. This week’s results include an adjustment for the Memorial

Day holiday.The Market Composite Index, a measure of mortgage loan application volume, decreased 1.4 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 12

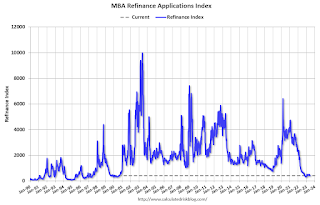

percent compared with the previous week. The Refinance Index decreased 1 percent from the previous

week and was 42 percent lower than the same week one year ago. The seasonally adjusted Purchase

Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 13 percent

compared with the previous week and was 27 percent lower than the same week one year ago.“Mortgage rates declined last week from a recent high, but total application activity slipped for the fourth

straight week. The 30-year fixed rate dipped to 6.81 percent, 10 basis points lower than last week but still

the second highest rate of 2023 to date,” said Joel Kan, MBA’s Vice President and Deputy Chief

Economist. “Overall applications were more than 30 percent lower than a year ago, as borrowers continue

to grapple with the higher rate environment. Purchase activity is constrained by reduced purchasing

power from higher rates and the ongoing lack of for-sale inventory in the market, while there continues to

be very little rate incentive for refinance borrowers. There was less of a decline in government purchase

applications last week, which was consistent with a growing share of first-time home buyers in the

market.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($726,200 or less) decreased to 6.81 percent from 6.91 percent, with points decreasing to 0.66 from 0.83

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 27% year-over-year unadjusted.