Other key reports include the June ISM Manufacturing survey, June Vehicle Sales, May Job Openings and the Trade Deficit for May.

—– Monday, July 3rd —–

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 47.2, up from 46.9 in May.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

The consensus is for light vehicle sales to be 15.3 million SAAR in June, up from 15.1 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

Wards Auto is forecasting sales of 15.9 million SAAR in June.

US markets will close at 1:00 PM ET prior to the Independence Day Holiday.

—– Tuesday, July 4th —–

All US markets will be closed in observance of Independence Day

—– Wednesday, July 5th —–

8:00 AM: Corelogic House Price index for May.

2:00 PM: FOMC Minutes, Meeting of June 13-14, 2023

—– Thursday, July 6th —–

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 236,000 payroll jobs added in June, down from 278,000 in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, up from 239 thousand last week.

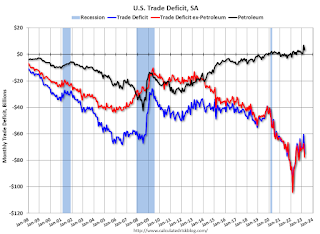

This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $69.8 billion. The U.S. trade deficit was at $74.6 billion the previous month.

This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in April to 10.1 million from 9.7 million in March.

The number of job openings (yellow) were down 14% year-over-year and quits were down 16% year-over-year.

10:00 AM: the ISM Services Index for June. The consensus is for a reading of 50.5, up from 50.3.

—– Friday, July 7th —–

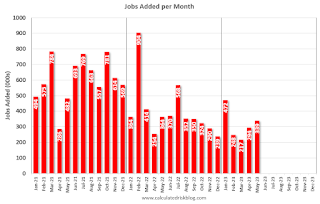

8:30 AM: Employment Report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for June. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

There were 339,000 jobs added in May, and the unemployment rate was at 3.7%.

This graph shows the jobs added per month since January 2021.