These tweets from a few days ago caught my eye:

I think David is right. We do know why rate increases have failed to slow the economy, if “we” means market monetarists. But Weisenthal is right that the mainstream is puzzled by this fact.

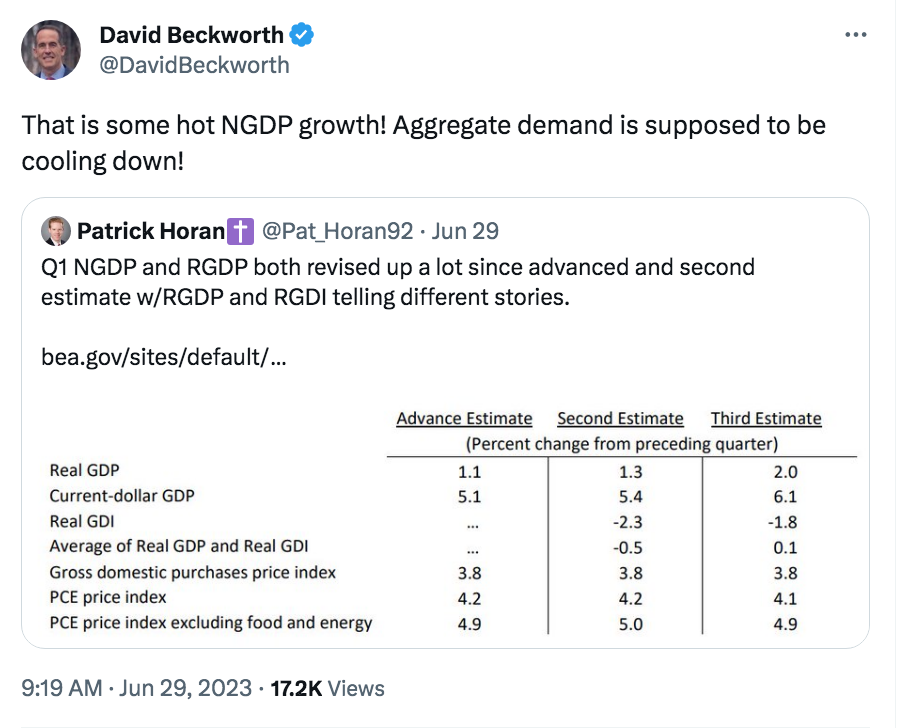

Actually, I’m still not sure that rates have “caught up” to the natural rate. A couple days later we saw these tweets:

So the 2023:Q1 NGDP slowdown mostly reflected bad initial data. That’s why I pay a lot of attention to high frequency labor market data, such as the payroll report. It often provides the best snapshot of the current state of the economy.

Of course this is all backward looking data, and its possible that NGDP growth will slow sharply going forward. But I recall people making that claim last year, and we now know that the doves of 2022 were wrong—policy was clearly too easy last year.

There’s no mystery here—easy money is generating fast NGDP growth, and that’s why core inflation remains stubbornly elevated.