I was sad to see that James Bullard is retiring from his position as president of the St. Louis Fed. He was a fan of NGDP level targeting, and as David Andolfatto points out he was willing to dissent in both dovish and hawkish directions. He will be missed.

I don’t like monetary policy hawks and doves. Policy should be expansionary at some times (e.g., when I started blogging) and contractionary at others (right now.) Bullard understood this.

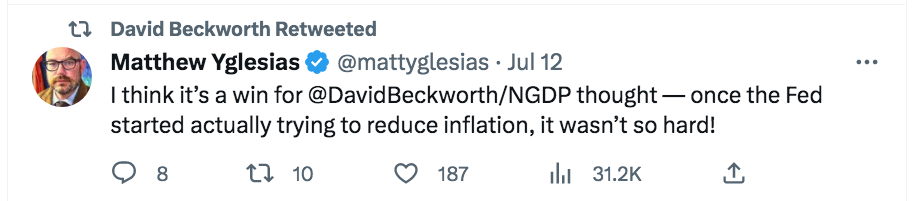

David Beckworth directed me to these tweets:

I’ve always been skeptical of the economic slack theory of inflation. There’s no way FDR could have generated high inflation in 1933 if the slack theory were true. I see inflation as being driven by changes in NGDP growth (monetary policy), and slack is something that happens if NGDP decelerates too rapidly.

But so far, NGDP growth has not decelerated too rapidly, indeed I’ve argued it’s decelerated too slowly. Even so, far worse things could have happened, and in the past often did happen. Fed policy during late 2021 and early 2022 was really bad (after being good in 2020 and early 2021)—since then it’s been average. It’s decelerated, which is appropriate—but a bit too slowly. Let’s see what Q2 looks like.

Matt Yglesias is correct that the recent strength of the economy supports the NGDP view over the slack view:

I think that’s right. But we need to be careful here, as most of the hard part still lies ahead. The Fed needs to bring down wage inflation, and before it’s all over Krugman may end up being correct. Slack doesn’t cause lower inflation, but it’s usually a side effect of wage disinflation.

Victory would be getting back to 2% with only a small increase in slack. I discuss this in a recent post on the difficulty of achieving a soft landing.