Matt Yglesias has a new post discussing macroeconomic stimulus. He argues:

1. The recent success in bringing inflation down supports the expectations view of macro (he cites Christina and David Romer) rather than the “hydraulic” view (citing Larry Summers, Jason Furman, and Olivier Blanchard.)

2. The recent success in bringing inflation down supports the view that we should aim for a fast recovery after a recession, not the sort of slow recovery seen after 2008-09.

3. We should err on the side of overshooting the target, as overshoots are much easier to deal with than undershoots.

I’m a long time proponent of the expectations view (and critic of the hydraulic view), and I’m also a long time proponent of aiming for quick recoveries. So I’m generally in sympathy with Yglesias’s views. But I do have a few minor reservations.

While I think there’s a decent chance of getting a soft landing, we are further from that goal than you’d assume from looking at the inflation data, especially headline inflation. I cringe a bit when people talk about how little the unemployment rate has risen despite PCE inflation falling from 7% to 3%, and CPI inflation falling from 9% to 3%. Those aren’t the data points that matter.

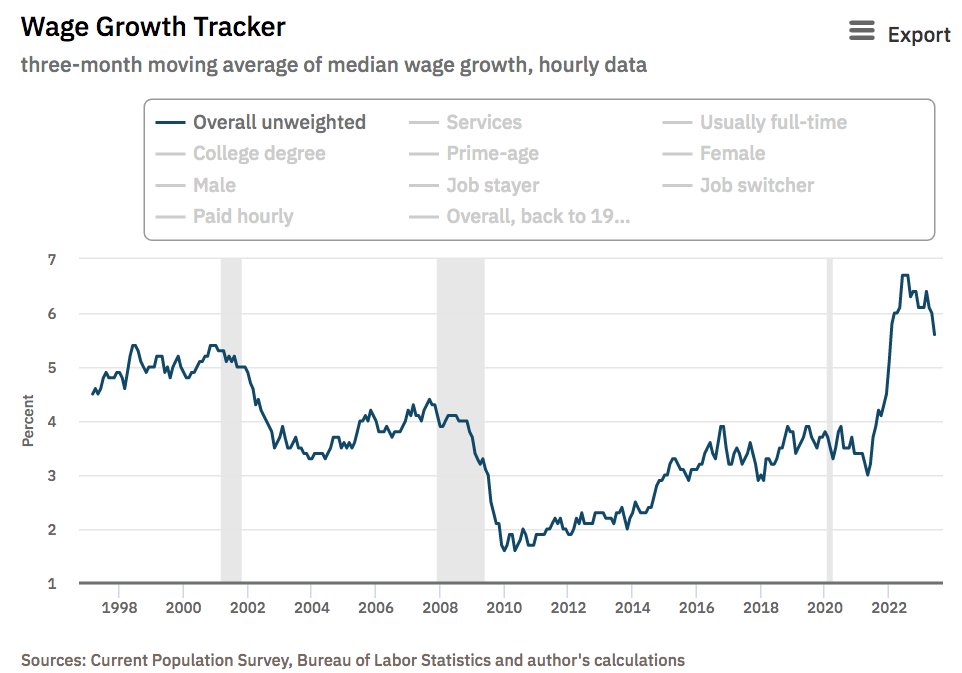

To be fair, Yglesias is aware that some of the gains are due to the fixing of supply issues, and it’s also worth noting that even the inflation rates that do matter (wage and core inflation) are coming down slightly. But we aren’t out of the woods yet. The Atlanta Fed has a wage tracker that tries to adjust for compensation effects:

And while NGDP growth slowed nicely in Q2, I notice that the first Atlanta Fed forecasts for Q3 are nearly 4% (implying about 7% for NGDP?) That’s a very early forecast, but in past inflation cycles there have been false dawns, so I’d still like for policy to err a bit on the side of tightness. (BTW, the Atlanta Fed hit Q2’s RGDP (at 2.4%) right on the nose.) Don’t get cute!

I’ve always thought soft landings were technically possible by slowing NGDP growth at a gradual pace. But they are not easy to achieve.

As far as the appropriate policy regime, I’m sticking with NGDPLT, even if the costs of undershoots are bigger than overshoots. I think NGDPLT would prevent big demand side recessions, so the practical difference isn’t that great. And if we are so clumsy that we continue to have big demand side recessions, then there’s no reason to expect Yglesias’s approach to policy wouldn’t also be ineptly implemented. In addition, I worry about “political economy” implications of a growing perception that we should tend to err on the side of dovishness. Might we stumble back into the situation of the 1960s? The 60s were fine—but that hangover . . .

If we are to use fiscal stimulus (something Yglesias favors and I oppose) then the argument for overshoots is even weaker. Fiscal policy is very costly, even if rates are zero. That’s because the debt you accumulate at the ZLB will eventually be rolled over at higher rates.

PS. I’m open to the possibility that the labor market is a bit more flexible than in the second half of the 20th century, which would support Yglesias’s view. It’s too soon to tell.