Dear Warren,

Before I get into the reason for my letter, I want to convey my undivided respect for your investment acumen and career. Nobody can reasonably doubt that you are the greatest investor of all time. Some may say that you are the Michael Jordan of investing. Personally, I would say that Michael Jordan is the Warren Buffett of basketball. You’ve been doing it since 1956; nobody has done it better for longer – or ever will. I have learned a tremendous amount from you and you are the starting point for all young people serious about becoming great investors.

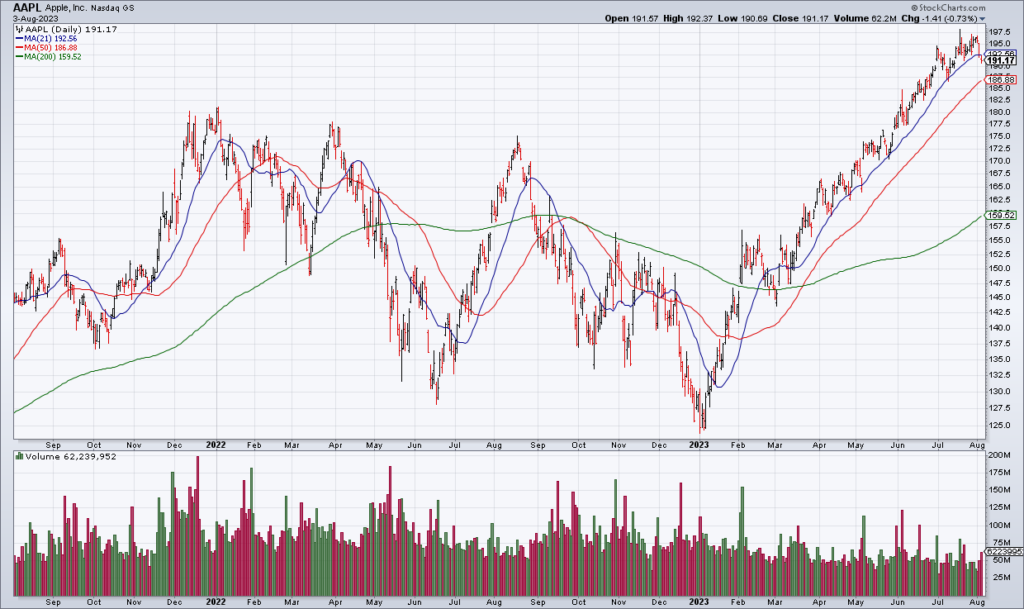

That said, something has been troubling me about your investment portfolio in recent years. To get to the point, it’s your highly concentrated position in Apple (AAPL). AAPL is the greatest stock of all time. But its recent results suggest that it’s past its prime. For instance, consider their 3QFY23 reported this afternoon. Revenue was -1% and Operating Income flat year over year. And it’s not just this one quarter; AAPL hasn’t had real growth for a couple years now. Services was adding some zest to the business for a while as the iPhone matured but that has petered out in recent quarters as well.

Even so, AAPL continues to trade at an earnings multiple that suggests it is still in its prime. It’s P/E ratio on what it will likely earn this year is greater than 30. In other words, the stock’s fundamentals can no longer support its premium valuation. Indeed, I argued on Sunday that AAPL is “the most overvalued stock in the market”. To rephrase something you once said, AAPL is like a 40 year old whore who was once the most beautiful one and is trying to hang on to her former glory. I know that you know all this and yet you have more than 900 million shares valued at about $175 billion.

I have a great memory from your annual meeting in Omaha in 2010. I still remember the wave of excitement that ran through me when the first question you were asked by one of the journalists was “from Greg Feirman” about the propriety of the synthetic CDO Goldman created for John Paulson to short the housing market in 2007. Now I have another question: What do you do with an apple when all that’s left of it is the core?

Best Wishes,

Greg Feirman