I believe that the next 12 weeks will be critical for the Fed’s anti-inflation program. During that period, we’ll get three more jobs reports and the 3rd quarter NGDP report. Hopefully, we’ll see a bit further progress on wage inflation, which is the only sort of inflation that actually matters for macroeconomic stability. And I hope that NGDP growth continues its recent downward trend (to 4.7% in Q2).

But that’s not what I expect to happen. I expect that NGDP will accelerate in Q3, perhaps to 7% or 8%. That would be bad! And I expect 12-month nominal wage growth (average hourly earnings) to accelerate above the current 4.4% figure. I hope I’m wrong, but I fear that the Fed still hasn’t actually achieved a contractionary monetary policy stance.

When will the tight money end? Perhaps the real question is, “When will the tight money begin?”

Come back in November, and you guys can all laugh at me if I’m wrong. Maybe we’ll be in recession. Heck, Bloomberg says there’s a 100% chance of recession by then.

PS. I see the media talking about how CPI inflation has fallen from 9% to 3.2%. I hope my readers are smart enough to ignore those sorts of meaningless data points.

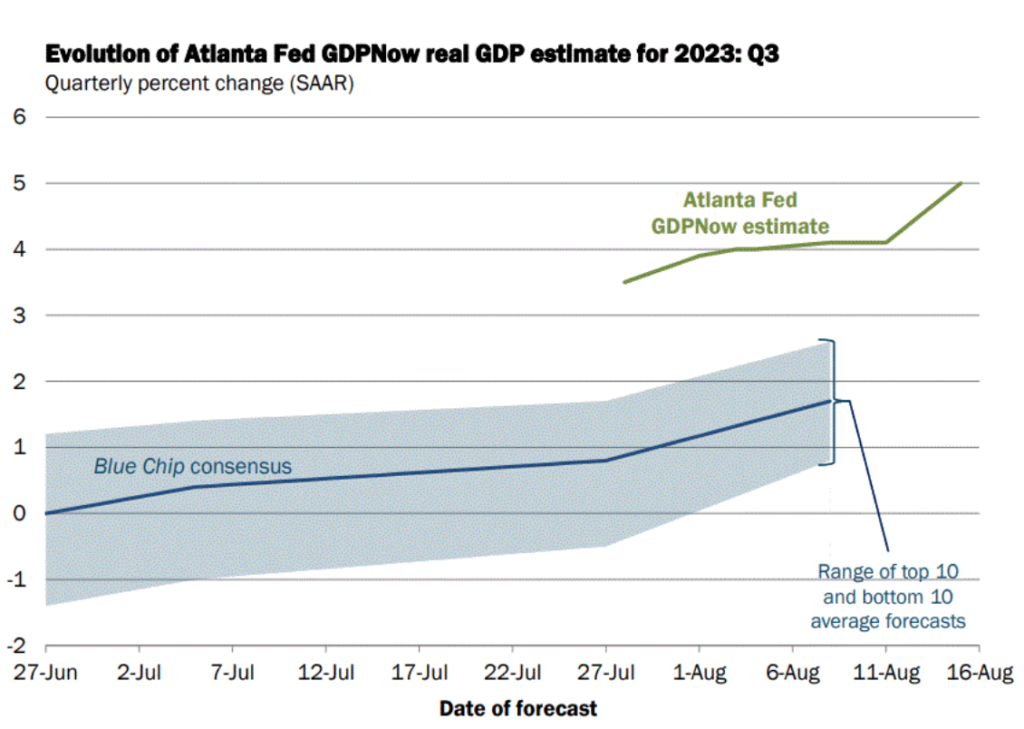

PPS. Here’s the Atlanta Fed’s current forecast for Q3 real GDP. Currently, they predict 5% RGDP growth. To get nominal GDP growth (which is what the Fed should care about), you need to add inflation.