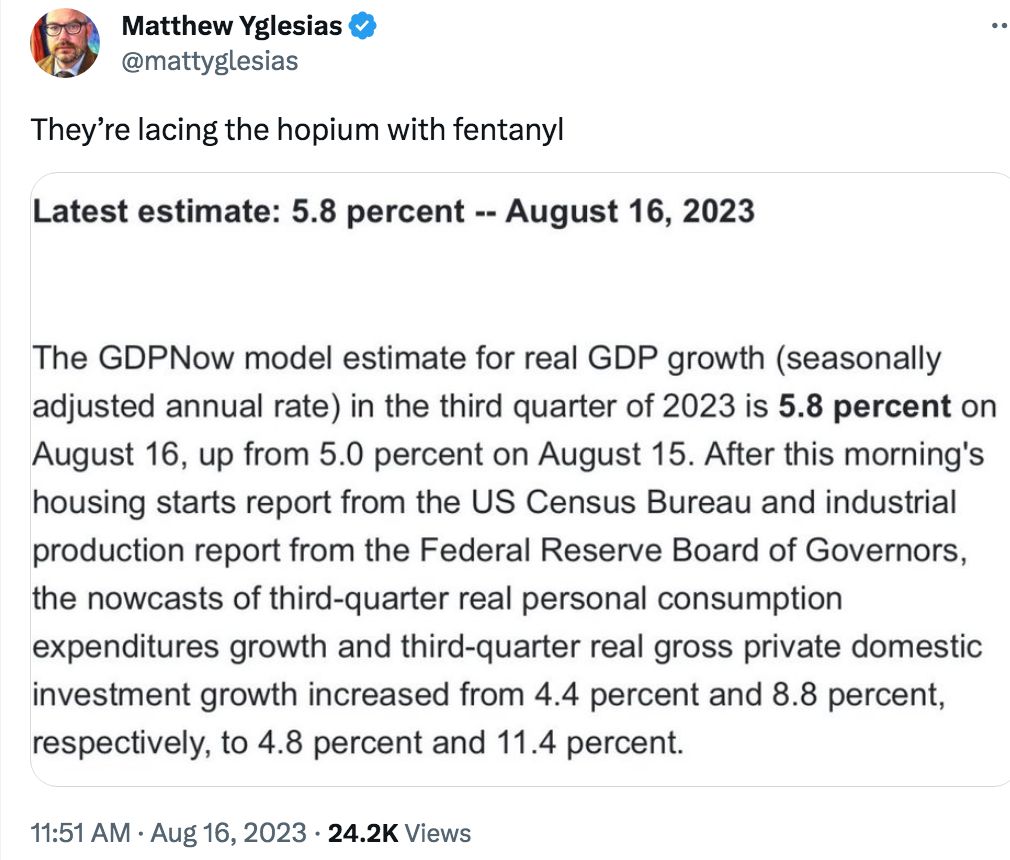

Another day, another upward revision over at the Atlanta Fed’s GDPNow:

Matt Yglesias is correct, this is good for the US economy in much the same way that fentanyl is good for one’s well-being. I’ve never taken that particular drug, but I imagine that it makes one feel good—for a while.

[Yeah, I know, Yglesias meant something else.  ]

]

So what’s wrong with 5.8% RGDP growth? Nothing, as long as NGDP growth is below 5%. But let’s be real; if RGDP comes in at 5.8%, then NGDP growth (which is what matters) will be 8% or 9%. And that would increase the risk of recession in 2024.

On the other hand, Bloomberg says there’s a 100% chance of recession by October, so perhaps the Atlanta Fed is wrong.

When RGDP came in negative during the first two quarters of 2022, I recall Keynesians suggesting it was the lagged effect of the Fed signaling tighter money in late 2021. Hawkish forward guidance. So this growth (if it happens) would be the lagged effect of exactly what?

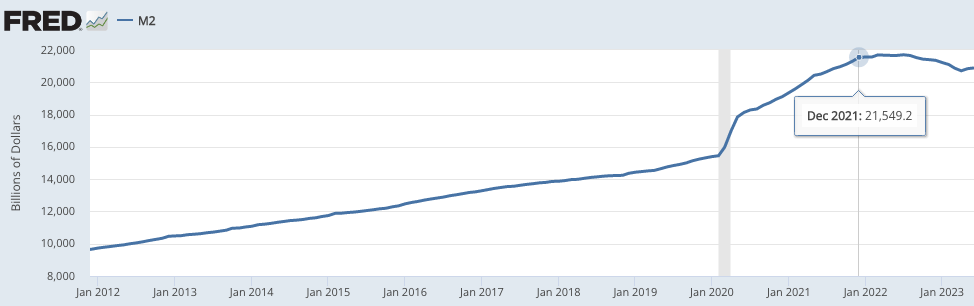

M2 leveled off after December 2021 and began falling after July 2022. Real M2 fell even earlier. So I’m not letting monetarists off the hook.

Even the markets have fallen a bit short.

As I keep saying, there’s not much evidence that the Fed adopted a contractionary policy in 2022.

All good arguments for level targeting.

PS. The case for optimism. And this.