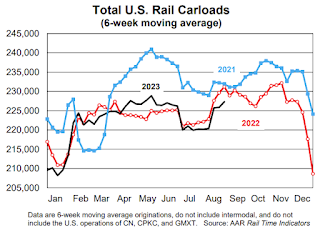

U.S. railroads originated 1.13 million total carloads in August 2023, down 2.0% from August 2022

and their third straight year-over-year decline. Total carloads averaged 226,675 per week in August

2023, very close to the weekly averages in March through June 2023.U.S. intermodal originations were down 6.3% in August 2023 from August 2022, their 24th year-over-year decline in the past 25 months. However, originations averaged 247,858 units per week in

August 2023, the most in 10 months. Intermodal remains subpar for a number of reasons, including a

continuing shift in consumer spending away from goods to services; a related sharp downturn in port

activity; and tougher price competition from trucks.

emphasis added

This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2021, 2022 and 2022:

U.S. railroads (not including the U.S. subsidiaries

of Canadian and Mexican railroads) originated 1.13 million

total carloads in August 2023, down 2.0% (23,323

carloads) from August 2022 and their third straight year over-year decline. Carloads averaged 226,675 per week

in August 2023, very close to the weekly averages in

March through June 2023. (July was lower because of the

July 4 holiday.)

A number of factors help explain why U.S.

intermodal volumes are down. Here are three. First, U.S.

consumer spending is shifting back toward services.

Goods as a share of total spending fell from a pandemic era peak of 35.8% in March 2021 to 33.2% in July 2023. Second, port activity is down sharply. Total

combined loaded imports and exports at major Western

U.S. ports were 20.6% lower (in terms of TEUs) in 2023

through July than in 2022 through July. For major Eastern

U.S. ports, the decline was 10.6%. That’s important

because imports and exports account for somewhere

around half of U.S. intermodal volume. Third, truck

competition is more intense today. Based on the

producer price index for truckload shipments, average truck rates in

July 2023 were 22% lower than in July 2022.