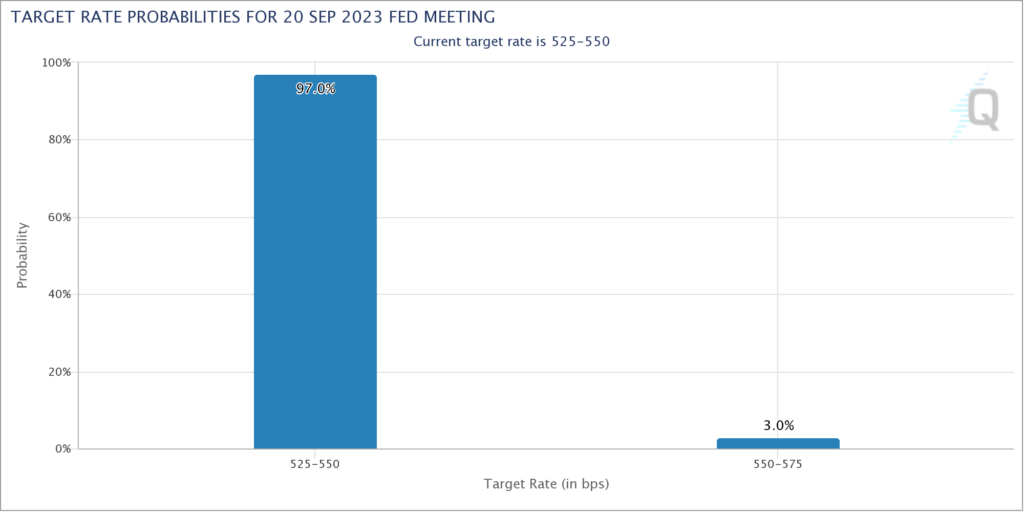

The focus next week will be on the Fed Decision on Wednesday at 2pm EST. However – despite the August CPI coming in slightly hotter than expected this Wednesday – the Fed is widely expected to pause. Whether they are done raising rates for this cycle or they might raise one more time later this year is 50/50 according the the Fed Futures (see Justin Lahart, “Betting Inflation Will Keep Falling Is Still A Risky Business” [SUBSCRIPTION REQUIRED], WSJ, September 15).

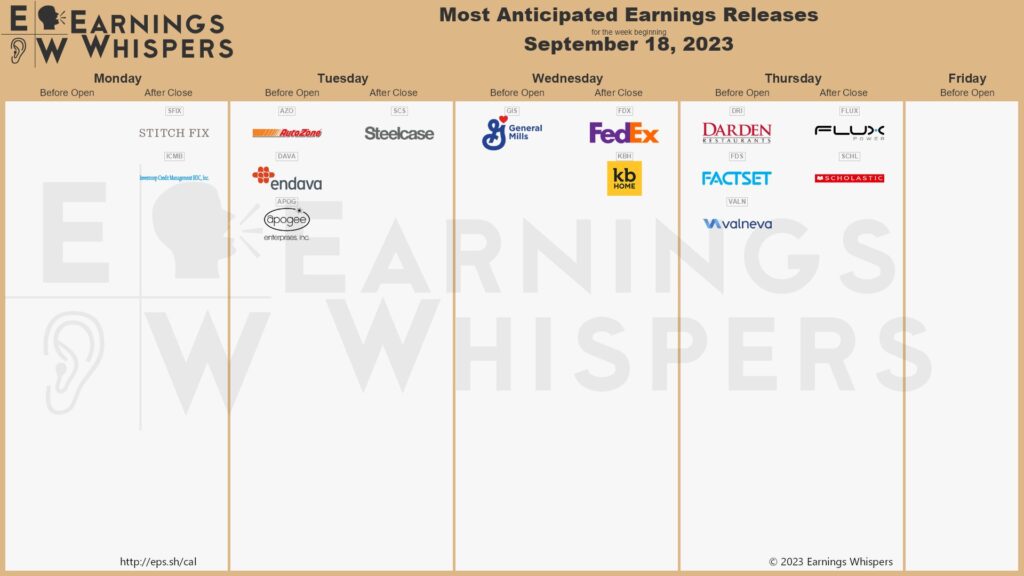

Moving on to the earnings reports for companies whose quarter ends at the end of August, first up is AutoZone (AZO) on Tuesday morning. AZO has been a terrific stock for as long as I can remember and I see no reason for that to change anytime soon. Comp growth slowed to 1.9% in the 12 week quarter ended May 6 and the stock got hit when they reported on May 23 – but has since stabilized. I have a small position that I’ve done well with and intend to continue holding the stock for the long term.

Next up on Wednesday morning is General Mills (GIS). The stock had been cruising but suffered a brutal reversal the last few months – though I’m not really sure why. Last quarter they guided FY24 organic sales to +3% to +4% on top of 10% growth in FY23 (which ended May 28, 2023). Adjusted EPS is expected to increase 4% to 6% from FY23’s $4.30. So the stock is trading for less than 15x current year EPS guidance and sports a 3.6% dividend. I think there’s value here and will be holding on to my small position.

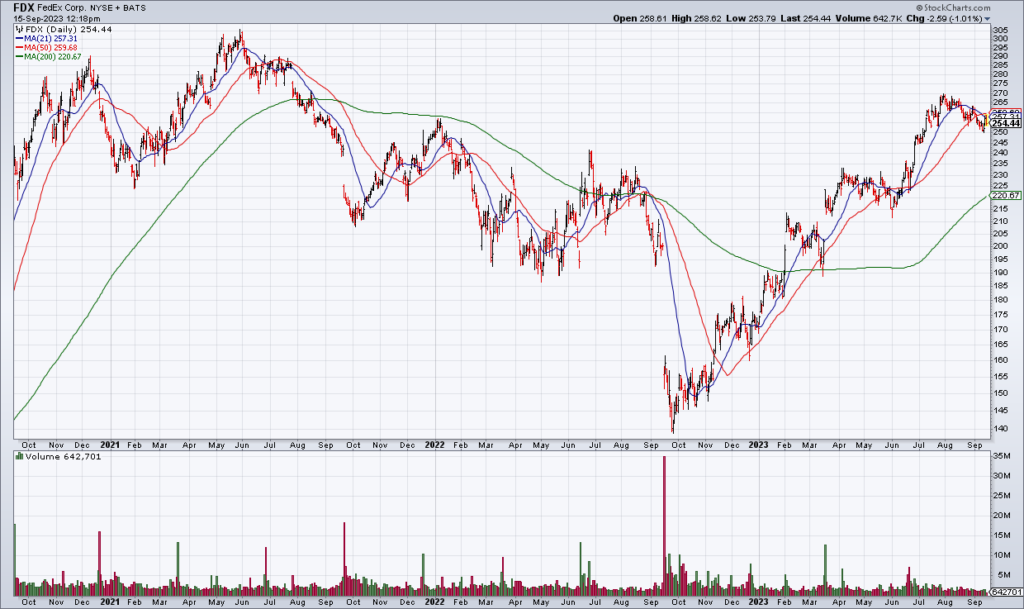

Federal Express (FDX) reports on Wednesday afternoon. A year ago, the stock crashed when they preannounced earnings and CEO Raj Subramaniam seemed to believe that the global economy was going into a recession. At the time, I thought it was a tell on the global economy and not company specific but in retrospect it does seem to be company specific. The stock has bounced back though volumes in both its Express and Ground divisions have been weak in recent quarters. Last quarter, they guided FY24 (ends May24) revenue growth to flat to up low single digits so perhaps things are stabilizing. I have a fractional short position that I will hold into earnings.

Also reporting Wednesday afternoon is KB Homes (KBH). While Lennar (LEN) reported a solid quarter yesterday afternoon, that was for the quarter that ended at the end of July. KBH will be the first homebuilder to report earnings for the quarter that ended at the end of August. I continue to think higher mortgage rates will put a damper on the housing market at some point – but it hasn’t happened so far. Nevertheless I will hold my fractional short position in KBH into earnings.

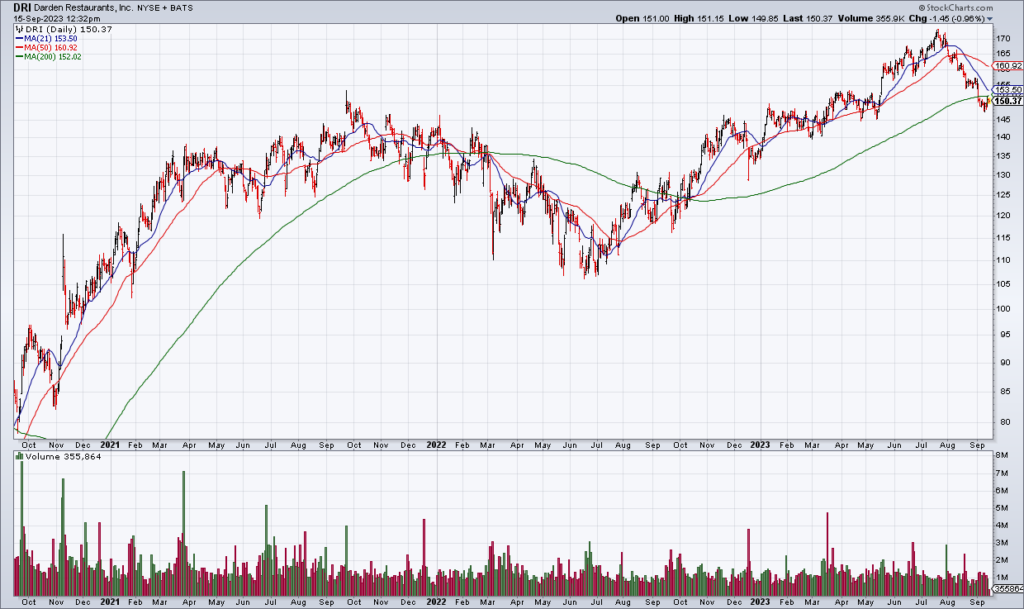

Last, on Thursday morning Darden Restaurants (DRI) – owner of the Olive Garden and other middle class restaurant chains – reports earnings. DRI guided FY24 (ends May24) comps to +2.5% to +3.5% and EPS to $8.55-$8.85. Because I continue to be bearish on the macroeconomy, I have a fractional short position in DRI that I will continue to hold as I wait for my thesis to be confirmed (or not).