From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Near Long-Term Highs

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Near Long-Term Highs

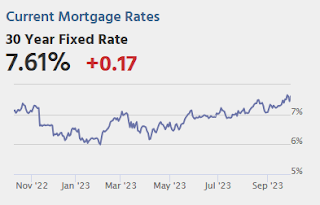

The average didn’t quite make it back to the multidecade highs seen last week, but the average borrower would see little–if any–difference in today’s rate quotes. This represents a fairly big jump up from Friday (which saw a nice correction down from Thursday’s highs).

There are a few culprits–some specific, some general. One specific culprit was the market’s reaction to the stop-gap bill that averted the government shutdown. Another specific and more obvious culprit was the stronger-than-expected outcome in today’s important manufacturing data. [30 year fixed 7.61%]

emphasis added

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for August.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.

• All day, Light vehicle sales for September. The consensus is for sales of 15.4 million SAAR, up from 15.0 million SAAR in August (Seasonally Adjusted Annual Rate).