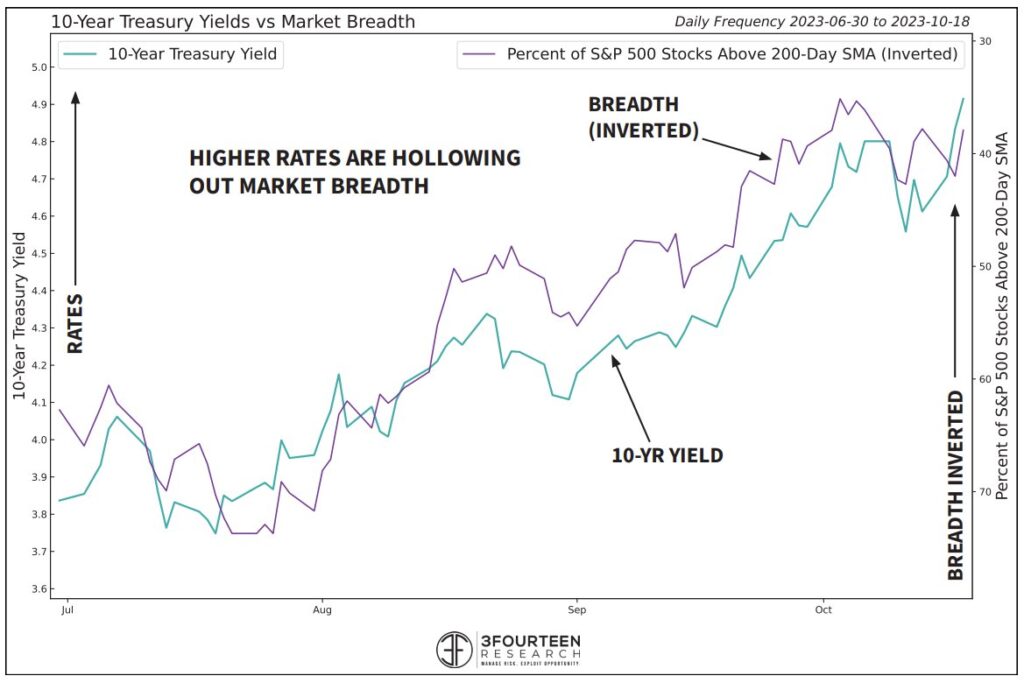

Fed Chair Powell sent interest rates soaring and tanked the stock market Thursday when he continued to press his “higher for longer” narrative at the Economic Club of New York. He doesn’t seem to understand that it’s time to change his tune because the relentless rise in interest rates is tightening financial conditions and crushing the stock market. As you can see above in a chart posted to Twitter a few hours ago by Warren Pies, as rates on the 10 year treasury continue to rise and are now at about 5% the number of S&P 500 stocks above their 200 DMAs is rapidly declining and is now below 40%.

As I said in the original “The Market Is About To Break” (Tuesday October 3), the only thing holding up the market cap weighted S&P is the Magnificent 7. The Equal Weight S&P (RSP) broke down below its 200 DMA a month ago. The market cap weighted S&P closed Thursday only about 1% above its 200 DMA. When that gives way imminently, it will become apparent that the rally off the October 2022 lows was in fact one of the biggest head fakes in market history (“The Bear Market Rally Is Over”, August 24) and the bear market begun in November 2021 will resume.