• The share of U.S. borrowers who were in serious mortgage delinquency (90 days or more late on payments) dropped to 0.9% in August, the lowest recorded since January 1999.

• The overall national mortgage delinquency rate (30 days or more late) was at 2.6% in August, also a historic low.

• The U.S. foreclosure rate held steady at 0.3% in August, unchanged since early 2022.

• Only Idaho and Utah saw slight annual upticks in overall mortgage delinquency growth in August, both up by 0.1 percentage point.

• Fifty-one metro areas posted year-over-year mortgage delinquency rate increases in August.

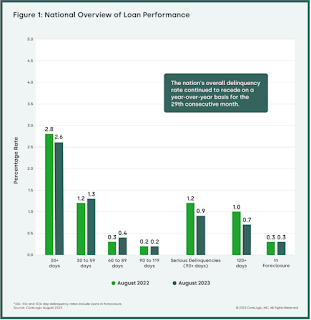

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In August 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

• Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in August 2022.

• Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in August 2022.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 0.9%, down from 1.2% in August 2022 and a high of 4.3% in August 2020.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from August 2022.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, unchanged from August 2022.