Heavy machinery maker Caterpillar (CAT) reported 3Q23 earnings Tuesday morning and the stock is breaking down below its 200 DMA at the open. While sales of $16.8 billion beat estimates and increased by 12% compared to a year ago, investors may have been expecting more. Like Federal Express, CAT is thought by many investors to be a barometer of macro economic activity.

Another stock I’m focused on this morning is the leading storage company Public Storage (PSA). Just as we’ve all seen CAT’s orange machines at construction sites, we’ve all seen PSA’s storage facilities alongside freeways all over the country. PSA’s stock has been hammered over the last 18 months but I’m a long term bull given the fact that Americans love to buy stuff and don’t have enough room to store it all at home. PSA guided 2023 Core Funds From Operations (FFO) to $16.60-$16.85 which gives the stock a 14x multiple on that metric. I think there’s value here.

Leading uranium producer Cameco (CCJ) also reported 3Q23 earnings Tuesday morning and the stock is pushing up against all time highs. I like CCJ and The Uranium ETF (URA) as plays on nuclear energy which has to be part of any rational long term energy plan.

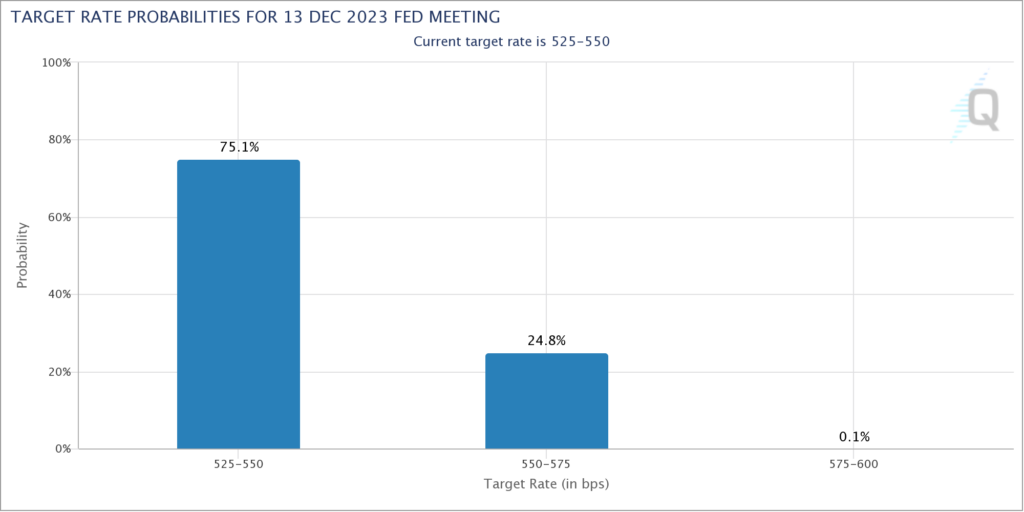

Last, while the Fed is essentially a lock to hold its target interest rate steady tomorrow, investors will be focused on the statement and Powell’s press conference to get a feel for how the Fed is leaning. While I think it’s time for Powell to dial back his hawkish tone, he very well not be ready to do that yet. The real debate is whether the Fed is done with its rate hiking campaign for this cycle. Fed Futures place a 25% probability of a final 25 point hike at the Fed’s last meeting of the year on December 13.