Mortgage applications increased 2.5 percent from one

week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending November 3, 2023.The Market Composite Index, a measure of mortgage loan application volume, increased 2.5 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1

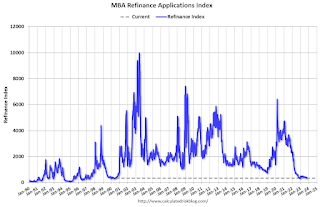

percent compared with the previous week. The Refinance Index increased 2 percent from the previous

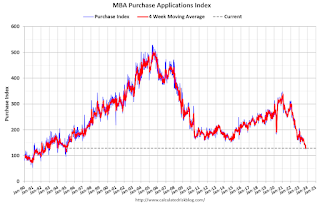

week and was 7 percent lower than the same week one year ago. The seasonally adjusted Purchase

Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 1 percent

compared with the previous week and was 20 percent lower than the same week one year ago.“The 30-year fixed mortgage rate dropped by 25 basis points to 7.61 percent, the largest single week

decline since July 2022,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Last week’s

decrease in rates was driven by the U.S. Treasury’s issuance update, the Fed striking a dovish tone in the

November FOMC statement, and data indicating a slower job market. Applications for both purchase and

refinance loans were up over the week but remained at low levels. The purchase index is still more than

20 percent behind last year’s pace, as many homebuyers remain on the sidelines until more for-sale

inventory becomes available.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($726,200 or less) decreased to 7.61 percent from 7.86 percent, with points decreasing to 0.69 from 0.73

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 20% year-over-year unadjusted.