From Matthew Graham at Mortgage News Daily: Mortgage Rates Undo Any Potential Damage From Last Friday

From Matthew Graham at Mortgage News Daily: Mortgage Rates Undo Any Potential Damage From Last Friday

n other words, the bond market pointed to a moderate jump in rates on Friday. There was a good chance the jump was an artificial byproduct of Thanksgiving week, but there was no way to be sure until today.

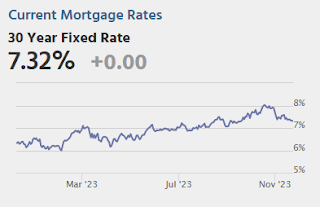

Now we’re sure. Bonds quickly moved back in line with Wednesday’s levels and the average mortgage lender did the same. That’s good news considering last Wednesday’s mortgage rates were right in line with the lowest levels of the past 2 months. [30 year fixed 7.32%]

emphasis added

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for September. The National index was up 2.6% YoY in August and is expected to increase further in September.

• At 9:00 AM, FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index. The 2023 Conforming loan limits will also be announced.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.