The net worth of households and nonprofits fell to

$151.0 trillion during the third quarter of 2023. The

value of directly and indirectly held corporate equities

decreased $1.7 trillion and the value of real estate

increased $0.5 trillion.

…

Household debt increased 2.5 percent at an annual rate

in the third quarter of 2023. Consumer credit grew at an

annual rate of 1.1 percent, while mortgage debt

(excluding charge-offs) grew at an annual rate of 2.5

percent.

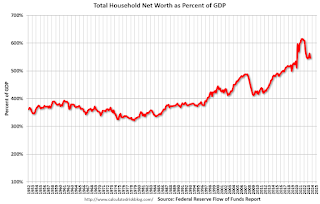

The first graph shows Households and Nonprofit net worth as a percent of GDP.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2023, household percent equity (of household real estate) was at 74.2% – up from 73.1% in Q2, 2023. This is close to the highest percent equity since the 1960s.

Note: This includes households with no mortgage debt.

Mortgage debt increased by $85 billion in Q3.

Mortgage debt is up $2.23 trillion from the peak during the housing bubble, but, as a percent of GDP is at 46.8% – down from Q2 – and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, decreased in Q3 – but is below the peak in Q3 2022 – but is well above the average of the last 30 years.