From Matthew Graham at Mortgage News Daily: Mortgage Rates Barely Budge, But Volatility Potential is Much Higher Tomorrow

From Matthew Graham at Mortgage News Daily: Mortgage Rates Barely Budge, But Volatility Potential is Much Higher Tomorrow

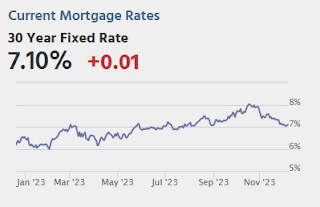

Jobs aside, inflation is the biggest nemesis for bonds/rates and the Consumer Price Index (CPI) is the biggest monthly revelation on the state of inflation. That’s precisely why tomorrow’s volatility potential is higher. The latest CPI will be released at 8:30am. If it’s higher than forecast, rates should rise. If it’s lower, rates should fall. If it comes in very far from forecasts, the movement could be quite abrupt. [30 year fixed 7.10%]

emphasis added

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for no change in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.1% year-over-year and core CPI to be up 4.0% YoY.