Excerpt:

From the NMHC: Financing Conditions Show Signs of Improvement, Apartment Market Continues to Loosen with Decreasing Deal Flow

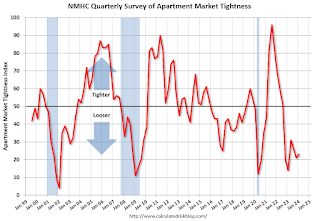

Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions for January 2024. With the exception of Debt Financing (66), which turned positive this quarter, the Market Tightness (23), Sales Volume (34), and Equity Financing (44) indexes all came in below the breakeven level (50).

…

“Yet, the apartment market continues to record decreasing rent growth and rising vacancy rates as it absorbs the highest level of new supply in more than thirty years.”• The Market Tightness Index came in at 23 this quarter – below the breakeven level (50) – indicating looser market conditions for the sixth consecutive quarter. A majority of respondents (59%) reported markets to be looser than three months ago, while only 5% thought markets have become tighter. Thirty-five percent of respondents thought market conditions had gone unchanged over the past three months.

The quarterly index increased to 23 in January from 21 in October. Any reading below 50 indicates looser conditions from the previous quarter.

This index has been an excellent leading indicator for rents and vacancy rates, and this suggests higher vacancy rates and a further weakness in asking rents. This is the sixth consecutive quarter with looser conditions than the previous quarter.

There is much more in the article.