The prices of stocks are affected by literally anything and everything that happens in our world… But these happenings do not make themselves felt in Wall Street in an impersonal way, like so many jigglings on a seismograph. What registers in the stock market’s fluctuations are not the events themselves but the human reaction to these events, how millions of individual men and women feel these happenings may affect the future – Bernard Baruch, My Story

One common mistake is to believe that stock prices accurately measure the worth of the underlying business. In fact, stock prices reflect the perceptions of market participants. That is, stock prices are subjective, not objective, in relation to the intrinsic value of the underlying business. They are simply a a function of supply and demand, of what the market is willing to pay at a given moment in time. Of course, there is no formula to give you the intrinsic value of a stock either. More on that later.

In addition, the stock market is a crowd, subject to crowd psychology. Human beings are not hyperrational creatures and crowds accentuate certain irrationalities in human nature. One irrational characteristic of human beings is their tendency toward conformity and crowds amplify this tendency. In his book The Crowd: A Study of the Popular Mind, Gustave Le Bon called this the law of the mental unity of crowds: “The sentiments and ideas of the persons [in a crowd] take one and the same direction.” For example, today Nvidia (NVDA) bulls are celebrating the evisceration of NVDA bears. But the truth is that there are very few NVDA bears, at least ones who are willing to short the stock. Only 27 million shares of NVDA were sold short (something like 1% of outstanding shares) as of 1/31, according to the NASDAQ. We all know how crazy things can get when everybody thinks the same way.

In theory, the solution is to analyze stocks rationally. That is, you figure out a stock’s intrinsic value and buy stocks whose intrinsic value is greater than their market price and sell stocks whose intrinsic value is less than their market price. In fact, this is exactly the solution recommended by Ben Graham and adopted by Warren Buffett i.e. value investing.

The problem is that value investing is an art not a science. There is no formula that can tell you the precise value of a stock. There are some heuristics, though, like the Price-To-Earnings (P/E) ratio. NVDA’s forward P/E is ~30. Is that cheap or expensive? The answer is that it depends. The P/E only takes into account one year of earnings while a stock’s value is comprised of all its future cash flows discounted back to a present value. But since the future is unknowable, all of the variables in discounted cash flow (DCF) model are assumptions. Certainly some assumptions are better than others but none of them are the absolute truth. Reasonable people can disagree about the assumptions – and that is true in the case of NVDA.

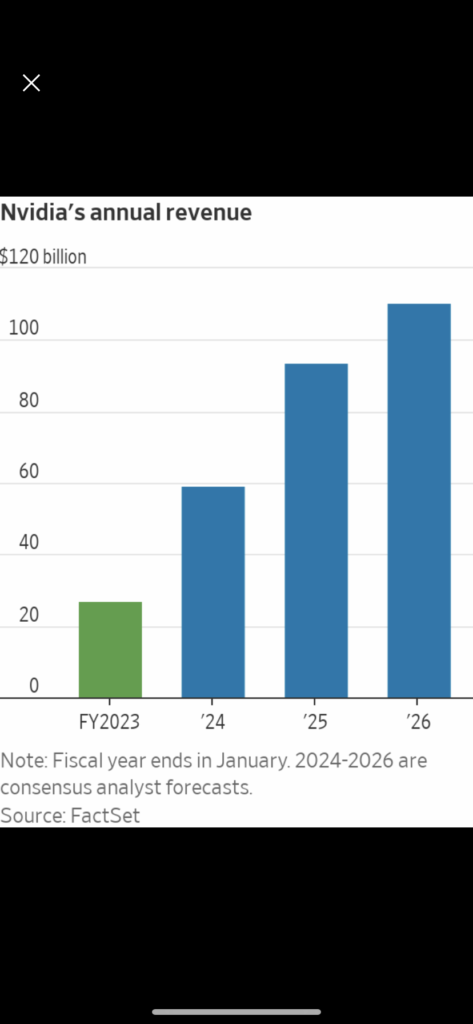

Analysts estimate NVDA will earn about $25/share in 2024. Even harder is determining how much NVDA will earn in future years, like 2025, 2026 and beyond. Much of the value of the stock depends on these earnings and your valuation on your assumptions about them. For example, if you believe that Artificial Intelligence is going to radically change the world, your assumptions about how big those out year earnings are going to be will be higher than someone who thinks it’s a fad. Inevitably, temperament comes to play a role here. Some people are optimists/believers and some pessimists/skeptics. Optimists/believers tend to think things are going to be really big and work out well while skeptics are more cynical and dubious. The difference between bulls and bears often comes down to this difference in temperament.