The U.S. passing the Inflation Reduction Act in 2021 took care of any misnomers about U.S. strategy, clearly prioritizing EV infrastructure and domestic production of all things EV. To wit, another race is underway: one to supply the metals critical to EV manufacturing, which has made the mining industry as exciting as it has been in decades.

The Metals to Look For

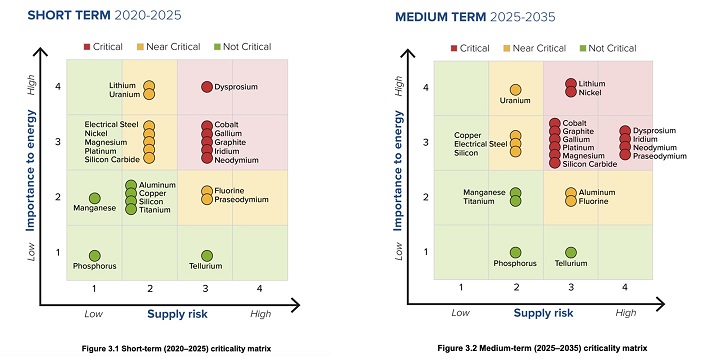

When it comes to importance to energy and supply risk, there are a bevy of metals that are both critical to energy and in danger of facing supply shortfalls based upon current production and expected future demand. Amongst these are nickel, lithium, cobalt, and graphite. Take note of the image sourced from the Department of Energy emphasizing the scenario in both the short and medium terms.

Savvy investors are looking to the metals in the upper half and upper right quadrant for a diversified portfolio in the sustainable energy markets to go along with companies investing heavily in battery technology, such as Tesla (NASDAQ: TSLA) and Siemens (OTC: SIEGY). Round out the portfolio with mining juggernauts like BHP Group (NYSE: BHP) or upstart Fathom Nickel (CSE: FNI) (OTCQB: FNICF), which is advancing two projects that could be integral to feeding North American supply in the coming decades.

The Young Explorer to Know in the Nickel Rush

Fathom Nickel is a Canadian exploration and development company riding the wave of the global nickel boom. Founded in 2015, the company focuses on acquiring, exploring, and developing high-grade nickel sulphide deposits. Fathom boasts a management team with over 100 years of combined mining and exploration experience that are shepherding the company’s two key projects in Saskatchewan, Canada:

• Albert Lake Project: Host to a past-producing mine, known for its high-grade nickel and copper, offers exploration potential for further resource development. The project spans a whopping 90,460 hectares in the heart of the famous Trans-Hudson Corridor.

• Gochager Lake Project: Recent drilling campaigns at Gochager Lake intersected promising nickel, copper, and cobalt mineralization, indicating significant exploration upside. Also expansive, Gochager Lake covers 22,620 hectares in the Trans-Hudson Corridor.

Well-funded thanks to a recent capital raise putting $4.57 million in its coffers, Fathom is actively advancing its projects through exploration drilling, resource estimation, and permitting processes. To that point, the company in February sunk a drill bit to launch a 5-7 hole (~2,000 meters) program at Albert Lake. Investors are waiting with bated breath for the completion of drilling and subsequent data that should better define the potential for resources in the metal-rich region and be a welcome addition to the library of historic data.

Right after drilling at Albert Lake is done, Fathom intends to initiate a similar sized drilling program at Gochager Lake.

The company, which remains mostly overlooked judging by its CDN$13 million market cap, seeks to establish itself as a leader in the Canadian nickel exploration industry, contributing to the clean energy revolution by supplying the critical metal needed for battery production. While still young, Fathom Nickel presents an intriguing opportunity for investors seeking grass roots exposure to the growing nickel market.

—

Fathom Nickel Inc. (CSE:FNI) (OTCQB: FNICF) Full Corporate Write-Up: Click Here.

—

About AllPennyStocks.com:

AllPennyStocks.com Media, Inc., founded in 1999, is one of North America’s largest and most comprehensive small-cap / penny stock financial portals. With Canadian and U.S. focused penny stock features and content, the site offers information for novice investors to expert traders. Outside of the countless free content available to visitors, AllPennyStocks.com Pro (premium service) caters to traders looking for that trading edge by offering monthly stock picks, daily penny stock to watch trade ideas, market commentary and more.

As a result of its commitment to journalistic excellence and abundance of information in a particular area of equity investing (micro-cap investing) where there aren’t many credible sources of information, AllPennyStocks.com continues to have one of the largest audiences of micro-cap investors on the internet.

Copyright © 2024 AllPennyStocks.com. All rights reserved. Republication or redistribution of AllPennyStocks.com’s content is expressly prohibited without the prior written consent of AllPennyStocks.com. AllPennyStocks.com shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

AllPennyStocks.com has been compensated eighty-four thousand dollars and was previously compensated sixty-nine thousand dollars by a third-party for its efforts in presenting the FNI profile on its web site and distributing it to its database of subscribers as well as other services. For a complete disclaimer, investors are encouraged to click here: https://www.allpennystocks.com/SpotLight/1101/Fathom-Nickel-Inc.htm

]]>