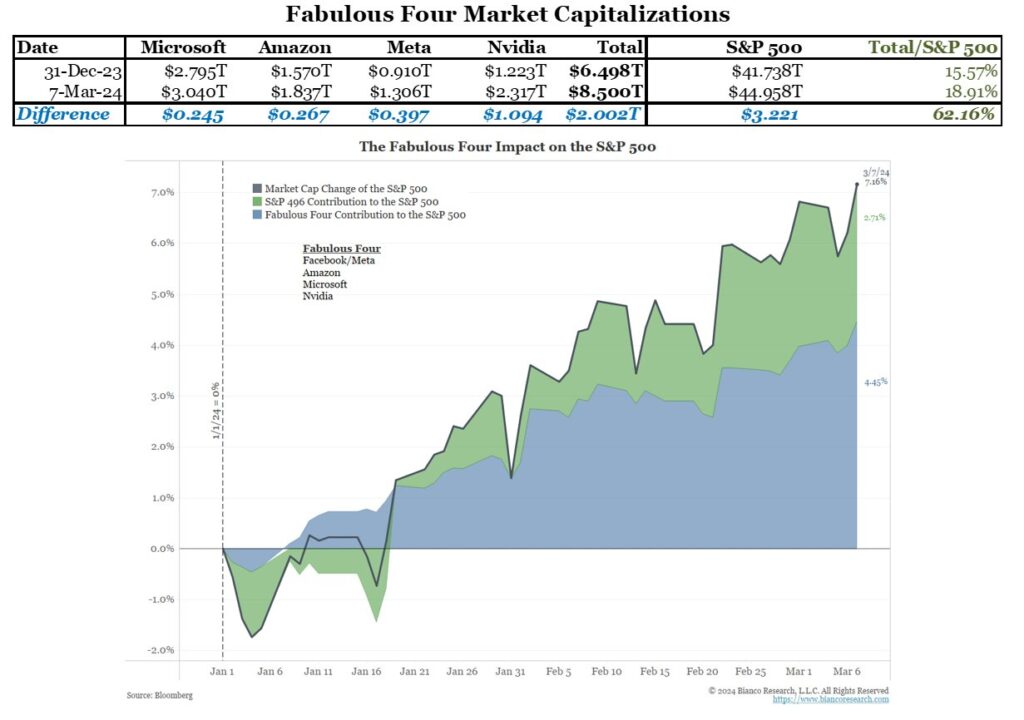

For many years Apple was the most important stock in the market but right now it’s Nvidia (NVDA). And on Friday, NVDA surged once again at the open but then made a high around 10:30am EST and reversed hard to the downside. From the high of the day to the low of the day, NVDA swung $89 representing $220 billion in market cap. As you can see in the second chart above, the broader market was led by NVDA.

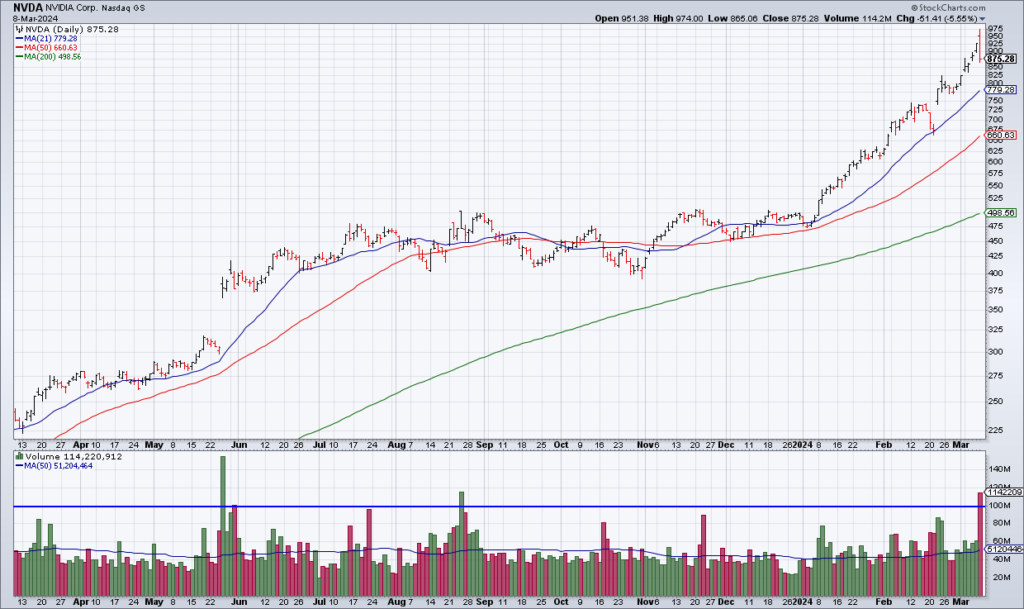

In the first chart, I’ve drawn a line in the volume at 100 million shares. As you can see, Friday was only the fourth day since the beginning of the AI hype in May of last year that volume has exceeded 100 million. When you have a big intraday reversal on heavy volume in a stock that has gone parabolic that almost always marks at least a short term top.

NVDA had added $1.094 trillion in market cap YTD through Thursday March 7. That amounts to 34% of the S&P’s total gain YTD. As a result, if Friday’s big reversal in NVDA marks an inflection point in the stock, it likely marks an inflection point in the overall market as well.

There are a few earnings reports next week but the focal point will be the February CPI on Tuesday morning at 8:30am EST. The Jobs Report on Friday was a Goldilocks number (not too hot, not too cold) the bulls were hoping for. Non farm payrolls were +275k and, importantly, January was revised down from +353k to +229k. Bulls would love to see February Core CPI come in at 0.3% Tuesday morning. That would keep the Fed on track to start cutting rates in May or June.