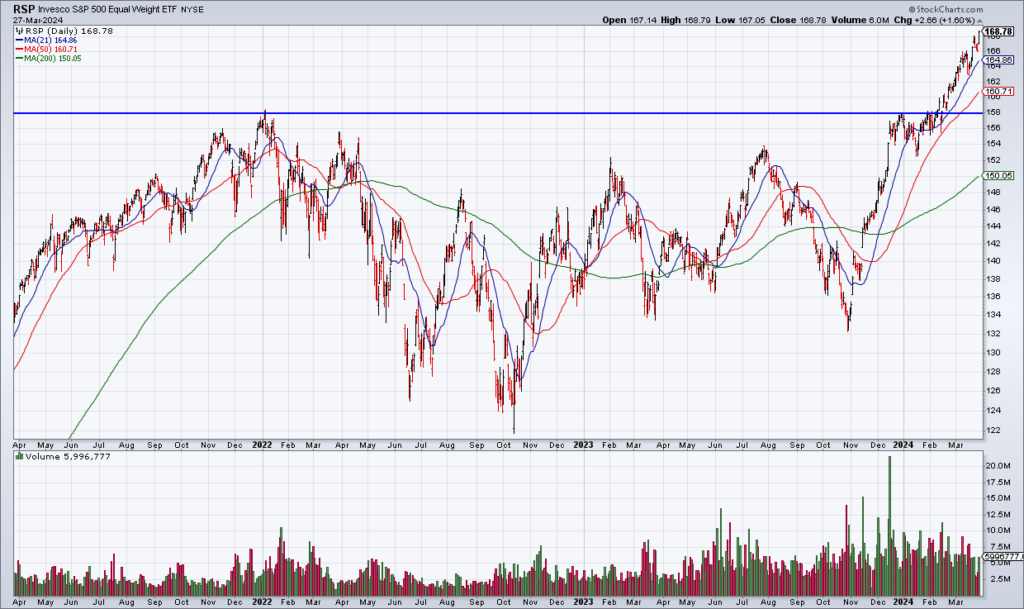

It’s getting harder and harder to make a bearish technical case against stocks. For a while, the argument was that the Magnificent 7 – with their huge size – were carrying the market higher and masking a lot of weakness beneath the surface. The evidence for this was the underperformance of the Equal Weight S&P (RSP) and Russell 2000 (IWM). However, as you can see in the RSP chart above, the Equal Weight S&P has broken out to new highs and is really moving now. In fact, as Frank Cappelleri pointed out in an excellent tweet this afternoon, RSP (+1.60%) and IWM (+2.18%) led the market Wednesday while Big Cap Tech (QQQ) lagged (+0.34%). That is a big change from what we saw last year and puts to rest any bearish technical arguments that I’m aware of. You can still be bearish – as I am – but it’s certainly a moment of “existential doubt” for those of us who are.

On the earnings front, Walgreens (WBA) reports earnings Thursday morning before the open. This is a stock that I have been wrongly bullish on. While I have cut back my position substantially, I’m still holding onto a nub. Clearly, something is wrong at WBA as operating margins have plunged over the last two years. As a result, EPS has declined from ~$5 in FY22 and FY21 to guidance of $3.20-$3.50 for FY24. Nevertheless, it is a quality brand and a very cheap stock at 6x guidance. Anything decent could result in a relief rally.

The market is closed Friday for Good Friday.