Meridian Funds, managed by ArrowMark Partners, released its “Meridian Small Cap Growth Fund” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. During the final months of the year, optimism prevailed due to news of reducing inflation and the potential for lower interest rates in 2024. The fund returned 13.64% (net) in the fourth quarter compared to the Russell 2000 Growth Index’s12.75% return. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Meridian Small Cap Growth Fund featured stocks like Mirion Technologies, Inc. (NYSE:MIR) in the Q4 2023 investor letter. Headquartered in Atlanta, Georgia, Mirion Technologies, Inc. (NYSE:MIR) offers radiation detection, measurement, analysis, and monitoring products and services. On March 27, 2024, Mirion Technologies, Inc. (NYSE:MIR) stock closed at $11.39 per share. One-month return of Mirion Technologies, Inc. (NYSE:MIR) was 16.94%, and its shares gained 41.32% of their value over the last 52 weeks. Mirion Technologies, Inc. (NYSE:MIR) has a market capitalization of $2.575 billion.

Meridian Small Cap Growth Fund stated the following regarding Mirion Technologies, Inc. (NYSE:MIR) in its fourth quarter 2023 investor letter:

“Mirion Technologies, Inc. (NYSE:MIR), a global leader in ionizing radiation measurement and detection, provides mission-critical and, in many cases, lifesaving technologies within the industrial (nuclear power) and medical (nuclear medicine and radiation therapy) sectors. Our investment in Mirion is predicated on three primary factors. First, the company operates in industries with strong secular trends. Second, approximately 75% of the company’s revenues are recurring or replacement, providing valuable transparency and predictability. Finally, the company competes in relatively fragmented markets, which leads to higher switching costs and strong pricing power. During the quarter, the stock advanced as the company reported 17% organic growth, significantly better than expected. The report added to investors’ confidence that growth may exceed management’s previously stated full-year revenue guidance of between 6-8%. We also have been encouraged by management’s disciplined capital allocation decisions, as the company has selectively acquired high-quality companies at attractive prices, while at the same time reducing leverage on its balance sheet. During the quarter, we maintained our position in Mirion and will continue to monitor valuation closely from here.”

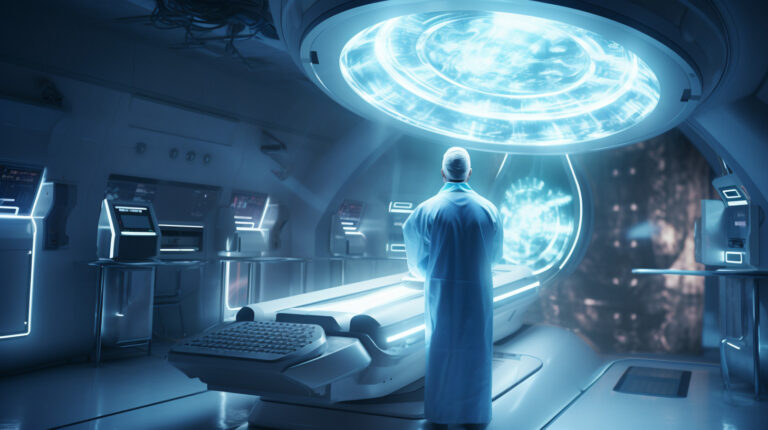

A radiation oncologist overseeing the delivery of radiation therapy to a patient.

A radiation oncologist overseeing the delivery of radiation therapy to a patient.

Mirion Technologies, Inc. (NYSE:MIR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, Mirion Technologies, Inc. (NYSE:MIR) was held by 23 hedge fund portfolios, compared to 22 in the previous quarter, according to our database. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 17 Countries with the Highest Number of Road Traffic Deaths

- 12 Most Undervalued Renewable Energy Stocks To Buy According To Analysts

- 20 US States with the Highest Electricity Consumption

Disclosure: None. This article is originally published at Insider Monkey.