I don’t know. But the possibility is greater than I would have wished to see.

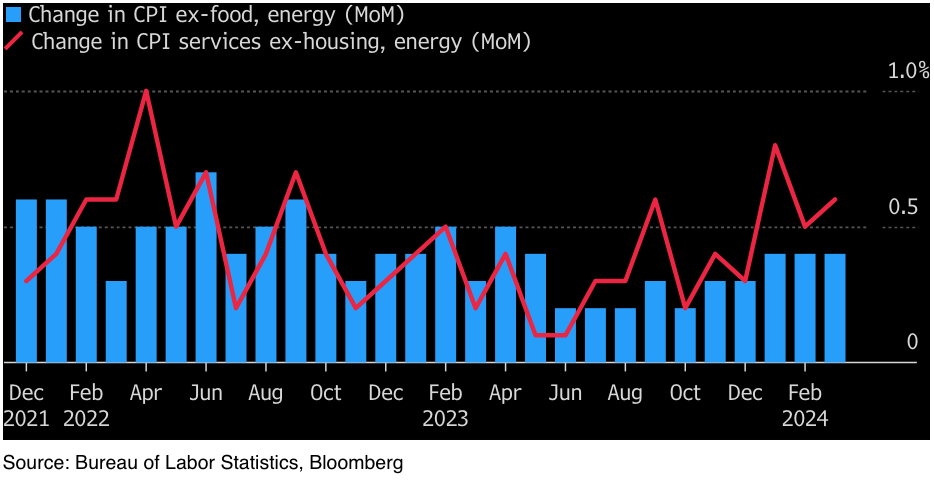

Inflation data is often noisy and unreliable, for a wide variety of reasons. Wage inflation is the most meaningful for monetary policy. Among all of the various price indices, the service sector inflation ex-housing and energy is probably the most closely tied to wages. Wages aren’t closely linked to housing or gasoline prices, but they are fairly closely linked to the price of haircuts, fast food, and medical care. And while this series is pretty noisy (red line), it does seem to be trending up since last May and June, when the monthly rate bottomed out at only 0.1% Here’s Bloomberg:

The most recent reading is 0.6%, and the most recent three month average is even higher than 0.6%.

Again, this data is erratic, and it may well slow again going forward. But as I’ve been saying ad nauseam over the past few years, it’s not at all clear that the Fed has adopted a tight money policy. Money is still too loose. I expect 2024:Q1 NGDP to be “hot”. In other words:

Wake me when the tight money starts.