Janan Ganesh has an piece in the FT entitled “The Rise of Bleak Chic”.

I don’t demand show trials or the ritual egging in public squares of people who were bearish on cities. There is no need for a mea maxima culpa from those who doubted if even the handshake, let alone the restaurant, would return. But let’s imagine that things were reversed: that we optimists were the ones proven wrong. We wouldn’t have been allowed to slink off like Homer Simpson into the hedge. There would have been recriminations.

There is an asymmetry in public life. If you err on the side of optimism, it can dog you forever. Ask Francis Fukuyama. Erring the other way incurs much less cost. Ask . . . well, whom? Who is the reference point for incorrect pessimism? If a name doesn’t occur, it’s because we tend to let these things go.

In the past, I’ve made a similar argument about asset price “bubbles”. Those who wrongly suggest that high prices are the new normal are mercilessly criticized after the crash. People still cite Irving Fisher’s claim that stocks had reached a permanently high plateau in 1929.

[Actually, Fisher’s claim was probably reasonable. Stock valuations were not out of line in 1929, and the crash occurred because of a severe economic depression that almost no one forecast.]

In contrast, asset price bears get off almost scot-free when asset prices soar after inaccurate bearish calls.

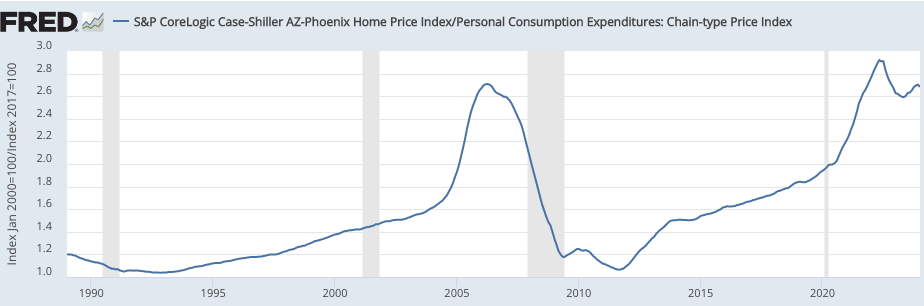

After the 2006-09 house price crash, claims were made that housing prices at the peak were obviously excessive. (Kevin Erdmann was a notable exception.) By the late 2010s, that no longer looked to be the case. But even then, people would often single out a few places like Phoenix as being obviously overpriced in 2006. Yes, they argued, high prices in California and New York might be justified by restrictions on new construction, but surely there was no justification for the insanely high prices in Phoenix, which is surrounded by endless expanses of desert. Even I found it hard to explain what had occurred.

Well, if prices in Phoenix were obviously irrational in 2006, they are just as high today. In the graph below I presented the Case-Shiller index deflated by the price level—in nominal terms Phoenix houses are now much more expensive than in 2006.

People that assured us that high prices in 2006 were justified are ridiculed, while we ignore those who suggested that the low prices of 2009-13 were justified.

Bleak chic is just one of the many psychological flaws that contribute to belief in bubbles.