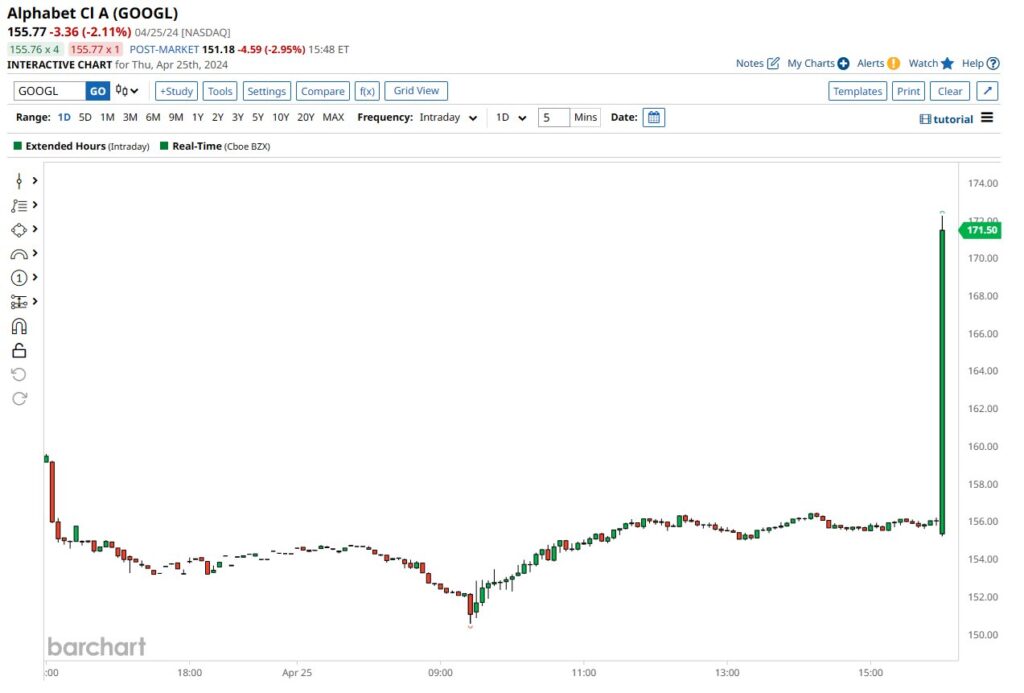

Google (GOOG/GOOGL) just reported a blowout quarter after the market close Thursday. Revenue was +15%, Operating Margin surged to 31.6% from 25.0% a year ago and EPS of $1.89 is up 62% from the year ago period. These are massive numbers so it’s no surprise the stock is currently +13% in the after hours to all time highs.

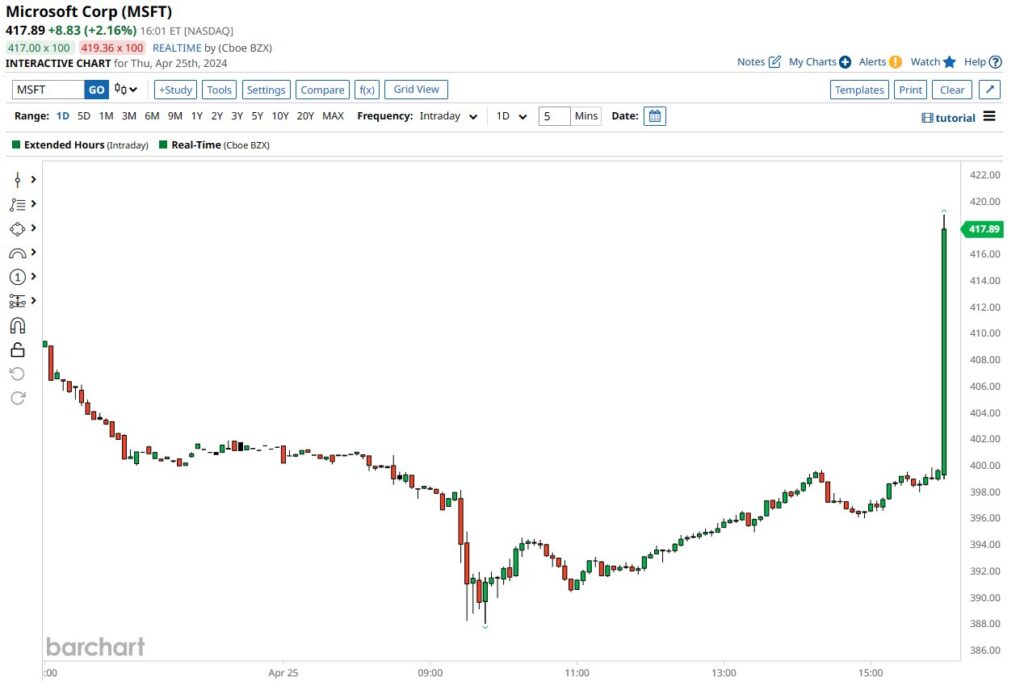

Microsoft (MSFT) also reported an excellent quarter after the market close Thursday. Overall revenue was +17% and Intelligent Cloud Revenue +21% compared to a year ago. Operating margin of 44.6% was up 230 basis points compared to 1Q23. EPS of $2.94 was +20% from the year ago period. Shares are currently +4% in the after hours. My concern with MSFT continues to be valuation as they are trading at more than 30x my FY24 EPS estimate.

In the wake of these reports and the minimal damage to the overall market today after Facebook’s (META) faceplant, the bulls are likely feeling pretty good about things. But we are still in a range between 4950 and 5250 on the S&P. Tomorrow’s session is going to tell us a lot about if I’m right that the 18-month “bear market rally” is over or if the bulls are that the last few weeks have just been a standard correction in an ongoing bull market.