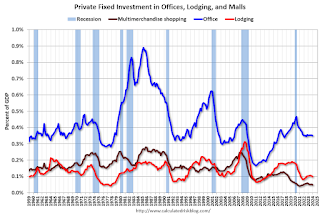

The BEA reported that investment in non-residential structures decreased at a 0.1% annual pace in Q1.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q1 and was up 4.1% year-over-year. And declined slightly as a percent of GDP.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 1% year-over-year in Q1. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1 compared to Q4, and lodging investment was up 1% year-over-year.

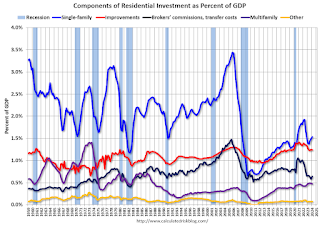

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Investment in single family structures was up to $433 billion (SAAR) (about 1.5% of GDP) and was up 16% year-over-year.

Investment in multi-family structures was down in Q1 compared to Q4 to $133 billion (SAAR), but still up 12% YoY.

Investment in home improvement was at a $351 billion (SAAR) in Q1 (about 1.2% of GDP). Home improvement spending was strong during the pandemic but has declined as a percent of GDP recently.