For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

—– Monday, May 27th —–

All US markets will be closed in observance of Memorial Day.

—– Tuesday, May 28th —–

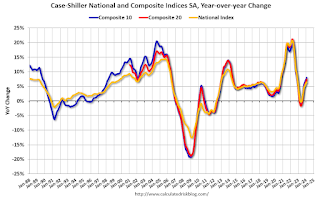

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

—– Wednesday, May 29th —–

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

—– Thursday, May 30th —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 215 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.2% annualized in Q1, down from the advance estimate of 1.6%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.6% decrease in the index.

—– Friday, May 31st —–

8:30 AM ET: Personal Income and Outlays, April 2024. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.7% YoY, and core PCE prices up 2.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.