In his article in Friday’s WSJ (“Nvidia’s Sucess Is The Stock Market’s Problem, Broadly” [SUBSCRIPTION REQUIRED]), James Mackintosh outlined the two things driving stocks: demand for AI chips and concern about the economy and interest rates. The former is pushing up semiconductor stocks and the Big Tech companies expected to benefit from AI while the latter is hurting most of the rest of the market. Hence, a bifurcated market with a few winners – NVDA and the rest of Big Tech – and a lot of losers like the Equal Weight S&P (RSP) and The Russell 2000 (IWM). Mackintosh’s concern is that NVDA has accounted for 40% of the S&P’s gain since the beginning of 2022 so any slip up there would pressure the major indexes. And in fact that’s just what happened on Thursday and Friday when NVDA reversed to the downside, pulling the S&P red as well.

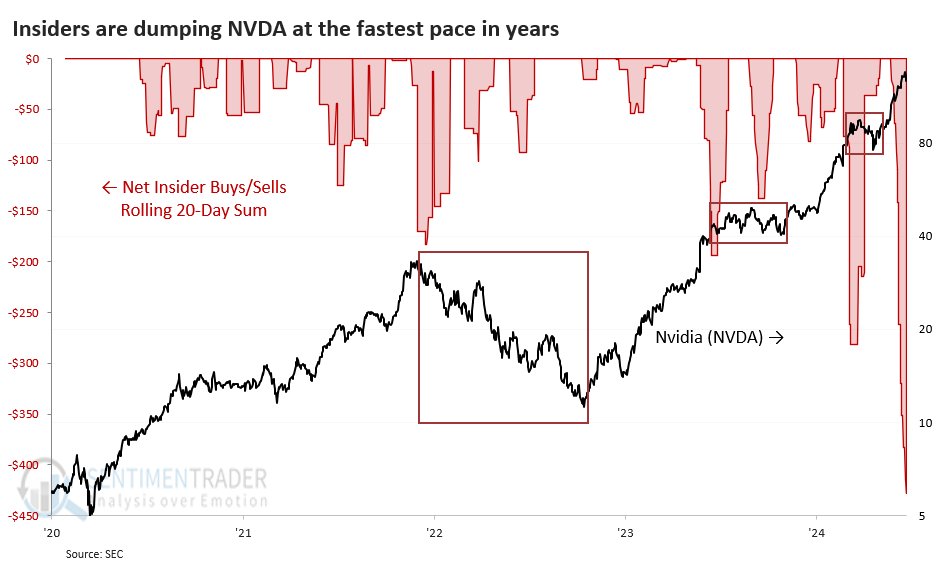

There are a lot of reasons to think NVDA can’t go much higher. First: valuation. NVDA is now trading at 30x sales for the current year. In his Tech Trader column in Barron’s this weekend, Eric Savitz cited research from Bernstein’s Toni Sacconahgi showing that stocks trading at price-to-sales multiples above 15x tend to be terrible investments. Stocks trading above 20x have performed even worse (“Nvidia Soars, History Advises Caution” {SUBSCRIPTION REQUIRED]. Further, insiders are selling at rates never seen before as you can see in the chart above by Jason Goepfort.

Meanwhile, we have a two tier economy divided between those who own financial assets like stocks and real estate which have performed incredibly, massively increasing their wealth, and those who don’t and rely primarily on their paychecks to fund their spending. The former are doing just fine but the latter are struggling. For instance, Darden Restuarants (DRI) reported Thursday morning that sales at its flagship Olive Garden restuarant – which caters to the middle classed – declined 1.5% in the quarter ended May 26, 2024. That the Fed remains hawkish isn’t helping things for this cohort. The first live meeting at which the Fed is expected to lower interest rates isn’t until September 18.