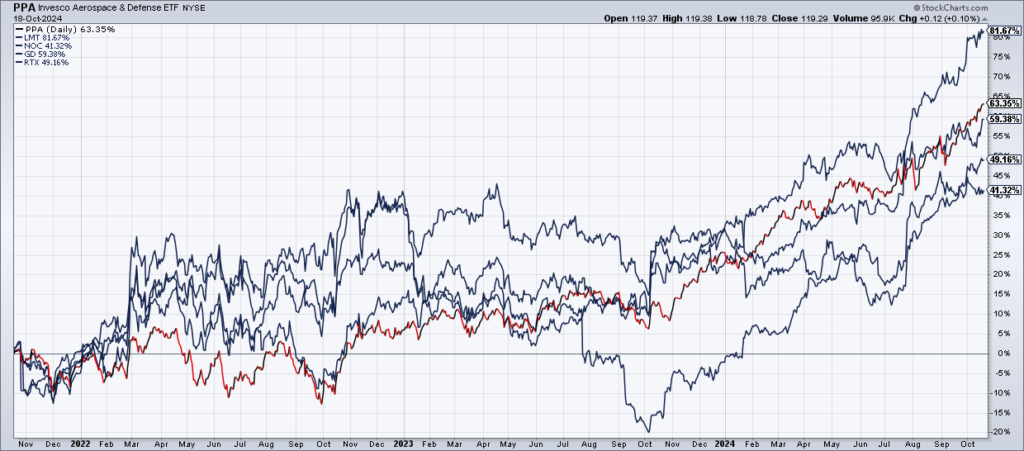

As we enter the 2nd full week of 3rd quarter earnings, one of my focuses will be the leading defense stocks – Lockheed Martin (LMT), RTX (RTX), General Dynamics (GD) and Northrop Grumman (NOC) – all of which report next week. As you can see in the chart above of the above mentioned stocks plus the Invesco Aerospace and Defense ETF (PPA) defense stocks have perked up nicely in the last year.

The obvious reason is the recent increase in geopolitical conflict. After the fall of the Soviet Union almost 35 years ago which ended the Cold War, the world has been relatively peaceful. The US has been the one dominant superpower in what defense analysts have termed the “unipolar moment”. Unfortunately, that period seems to have come to an end with Russia’s invasion of Ukraine, Hamas’s attack on Israel and increasing tensions between the US and China – especially over Taiwan.

Bears will argue that the recent surge in defense stocks is not due to earnings growth but multiple expansion. That’s true and and the four leading defense stocks mentioned at the top of this blog have become a bit pricey, trading at more than 20x current year EPS guidance.

As you can see in the chart above from a recent WSJ article by Jon Sindreu, the US defense budget has been declining relative to the size of the overall economy for more than a decade now – and that hasn’t changed yet. Since defense stocks depend on the Pentagon’s spending, their earnings won’t pick up unless the defense budget does. If it doesn’t, current valuations are unsustainable (“As Conflict Spreads, Will Defense Stocks Regain Their Cold War Allure?” [SUBSCRIPTION REQUIRED], Jon Sindreu, WSJ, October 11, 2024). The bull case is that recent geopolitical conflicts are a harbinger of things to come as we enter an increasingly dangerous phase in world history and eventually the US will have to wake up.

Disclosure: Top Gun is long shares of LMT, NOC and PPA.